Published on October 25, 2024

Exhibit 2.1

Execution Version

ASSET PURCHASE AGREEMENT

This ASSET PURCHASE AGREEMENT (this “Agreement”) is made and entered into as of October 22, 2024, (“Effective Date”) by and among Legacy Education Antioch, LLC, a California limited liability company (“Buyer” or “Legacy”), and Buyer’s parent entities, Legacy Education, LLC, a California limited liability company (“Buyer Parent-1”), and Legacy Education, Inc., a Nevada corporation (“Buyer Parent-2” and, together with Buyer Parent-1, the “Buyer Parents”), the Buyer Parents joining herein only for the purpose of guaranteeing the performance by Buyer of its obligations hereunder as set forth in Section 8.14 (Buyer and the Buyer Parents collectively being referred to herein as the “Buyer Parties” or the “Legacy Parties”), and Contra Costa Medical Career College, Inc., a California corporation (“CCMCC”), Contra Costa Medical Career College Online, Inc., a California corporation and an Affiliate of CCMCC (“CCMCC Online” and together with CCMCC, “Sellers”) and, solely with respect to Sections 5.3, 5.8, 5.12 and 7.2 (a)(ii)(solely concerning the covenants in Section 5.8) Stacey Orozco and Bulmaro Orozco, the sole owners CCMCC and CCMCC Online (each, an “Owner” and collectively, the “Owners”). Each of the Buyer Parties, Sellers and the Owners may be referred to in this Agreement individually as a “Party” and collectively as the “Parties.”

RECITALS:

A. CCMCC owns and operates Contra Costa Medical Career College (the “College”), operating under DOE OPE ID 04274900, which is located at 4041 Lone Tree Way, Suite 101, Antioch, CA 94531 (the “College Campus”) and which is a BPPE licensed and ACCET accredited institution eligible to participate in the HEA Title IV federal student aid programs. The College, with the assistance of CCMCC’s Affiliate CCMCC Online, offers online programs (which shall be included in the definition of “College”), and, with the assistance of CCMCC’s Affiliate Contra Costa Community Outreach Clinic and Laboratory (“Contra Costa Clinic”), offers externship opportunities to students and services to citizens in Antioch, California and surrounding communities.

B. Sellers wish to sell the assets comprising the College and CCMCC Online to a company that will continue to operate the College and lease the College Campus from CCMCC’s Affiliate, Evergreen Properties SBLD, LLC, a California limited liability company (“Campus Landlord”), which owns the College Campus real property. Buyer is willing to purchase the assets and to enter into a lease of the College Campus (the “Campus Lease”), all on mutually agreeable terms set forth hereafter and subject to all required regulatory approvals and third-party consents, and thereafter to continue to operate the College.

C. The Parties’ execution of, and closings and performance under, this Agreement and the Campus Lease, along with customary ancillary agreements, are referred to herein as the “Transaction.”

In consideration for the mutual covenants and agreements set forth in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, the Parties agree as follows:

ARTICLE I

DEFINITIONS

The terms set forth in this ARTICLE I have the following meanings when used in this Agreement:

“ACCET” means the Accrediting Council for Continuing Education & Training.

“Accounting Firm” means Almich & Associates, or if such firm is unable or unwilling to serve as the Accounting Firm, such other accounting firm as mutually agreed upon by the Parties.

“Accounts Receivable” means all trade accounts receivable and all notes, bonds and other evidence of indebtedness of and rights to receive payments arising out of tuition payments or sales occurring in the usual conduct of the College as of the close of business on the business day immediately preceding the Closing Date, including, but not limited to, Student Receivables and any accounts receivable for institutional charges by students who are not enrolled and/or in good standing at the College.

“Actions” or “Proceedings” means any action, suit, proceeding, arbitration, Educational Agency or Governmental Authority investigation or audit.

“Affiliate” means, with respect to any Person, any other Person who directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control,” including the terms “controlled by” and “under common control with,” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of at least fifty percent (50%) of the voting securities, by contract or otherwise, including the ability to elect a majority of the members of the governing board of such Person.

“Applicable Law” means any law, statute, regulation, rule, ordinance, order, judgment, decision, or decree by any Governmental Authority or Educational Agency applicable to Sellers or the College.

“Assumed Contracts” means those Material Contracts of Sellers set forth on Schedule I-A.

“Assumed Liabilities” means:

(1) all liabilities of Sellers first arising or to be performed after the Closing under the Assumed Contracts (but not related to matters, facts or circumstances existing at, prior to or as a consequence of Closing);

(2) all post-closing student refunds for any student withdrawals occurring more than ten (10) days after Closing;

(3) the balance of the Unearned Tuition as of Closing; and

| 2 |

(4) any other liabilities set forth in Schedule I-B to be mutually agreed upon prior to Closing and included in the Final Capital Liabilities to the extent not expressly set forth in (1) – (3) above.

“Bill of Sale, Assignment and Assumption Agreement” means that bill of sale, assignment and assumption agreement to be executed by Buyer and Sellers, in the form attached as Exhibit A.

“BPPE” means the California Bureau for Private Postsecondary Education.

“Business Records” means all records of Sellers relating to the College, including all financial and accounting records, student and tuition records, agreements, lists (including current student and prospective student lists) and related information.

“Closing” has the meaning given that term in Section 6.1 of this Agreement.

“Code” means the Internal Revenue Code of 1986, as amended.

“Confidential Information” means any information, whether written, oral, electronic, website-based, or other form, concerning the College that is not already generally available to the public, including, without limitation, technical or financial information, forecasts, budgets, student and customer names, addresses, and related data, contracts, practices, services and support, procedures, software, reports, methods, strategies, plans, documents, drawings, designs, tools, models, and inventions.

“Contra Costa Clinic” means Contra Costa Community Outreach Clinic and Laboratory, a California nonprofit public benefit corporation.

“DOE” means the United States Department of Education.

“Educational Agency” means any entity or organization, whether governmental, government chartered, private, or quasi-private, that engages in granting or withholding Educational Approvals for private post-secondary colleges in accordance with standards relating to the performance, operation, financial condition, or academic standards of such colleges, including BPPE, ACCET, the DOE and any student loan guaranty agency.

“Educational Approval” means any license, permit, authorization, certification, accreditation, or similar approval required to be issued by an Educational Agency to CCMCC for the operation of the College.

“Environmental and Safety Requirements” means any Federal, state, local and foreign statutes, regulations, ordinances and similar provisions having the force or effect of law, all judicial and administrative orders and determinations, all contractual obligations and all common law concerning public health and safety, worker health and safety and pollution or protection of the environment, including all such standards of conduct and bases of obligations relating to the presence, use, production, generation, handling, transport, treatment, storage, disposal, distribution, labeling, testing, processing, discharge, release, threatened release, control, or cleanup of any hazardous materials, substances or wastes, chemical substances or mixtures, pesticides, pollutants, contaminants, toxic chemicals, petroleum products or by-products, asbestos, polychlorinated biphenyls, noise or radiation.

| 3 |

“Escrow Agent” shall have the meaning given in Section 2.3 (d) of this Agreement.

“Excluded Assets” means:

(1) all cash, cash equivalents and bank accounts of Sellers;

(2) all rights to receive mail and other communications addressed to Sellers relating to any of the Excluded Assets or Liabilities that are not Assumed Liabilities;

(3) all corporate records of Sellers, including minute books and Organizational Documents;

(4) all personnel and other records Sellers are required by Applicable Law to retain;

(5) all rights of Sellers under this Agreement or any other agreements to be executed by Sellers in connection with the Closing;

(6) Tax refunds and estimated Tax payments and deposits relating to any period prior to the Closing Date and Tax returns and other related Tax records on previously filed returns;

(7) notes or other debt instruments pursuant to which any Affiliate of Sellers are indebted to any of Sellers;

(8) all rights, title and interest of Sellers in and to any insurance policies, and any cash surrender value or premium refund value in regard thereto, and all rights to applicable claims and proceeds thereunder to the extent related to the Excluded Assets or Excluded Liabilities;

(9) all claims, causes of action, rights of recovery, rights of set off and rights of recoupment of any kind related to any Excluded Liability or Excluded Asset;

(10) all rights of Sellers under any contract or agreement other than the Assumed Contracts;

(11) the Excluded Receivable; and

(12) any personal items that the Owners or Sellers will be retaining, which are set forth on Schedule I-C.

“Excluded Liabilities” has the meaning given that term in Section 2.2.

“Excluded Receivable” means the Accounts Receivable of Sellers with respect to any employee retention tax credit.

| 4 |

“Fraud” means with respect to any party, an actual and intentional misrepresentation of a material existing fact with respect to the making of any representation or warranty in this Agreement made by such party, (a) with respect to Seller, to the Knowledge of Seller or (b) with respect to Buyer, to Buyer’s actual knowledge, of its falsity and made for the purpose of inducing the other party to act, and upon which the other party justifiably relies with resulting Losses. For the avoidance of doubt, Fraud shall not include any claim for equitable fraud, constructive fraud, promissory fraud, unfair dealings fraud, fraud by reckless or negligent misrepresentations or any tort based on negligence or recklessness.

“GAAP” means United States generally accepted accounting principles as in effect from time to time, as consistently applied by Sellers.

“Gainful Employment Data” has the meaning given in Section 3.14(z).

“Governmental Authority” shall mean any federal, state, or local government or any court, administrative agency or commission, tribunal, arbitrator, authority, official, or agency, domestic or foreign, excluding any Educational Agency.

“HEA” means the Higher Education Act of 1965, as amended, and the regulations promulgated under it.

“Intellectual Property Rights” means, with respect to a company business and/or educational institution, all (i) trademarks, service marks, trade dress, trade names, brands, slogans, logos, Internet domain names, and corporate names, all translations, adaptations, derivations, and combinations of the above, and all applications, registrations, and renewals in connection with them, together with all of the goodwill associated with the above, (ii) copyrights and works of authorship (whether or not copyrightable), and moral rights, and all applications, registrations, and renewals, (iii) patents and patent applications, (iv) social media accounts and registrations, (v) trade secrets and other confidential or proprietary information, know-how, processes, methods and techniques, research and development information, industry analyses, drawings, specifications, designs, plans, proposals, industrial models, technical data, financial and accounting data, business and marketing plans and customer and supplier lists and related information, and (vi) copies and tangible embodiments of any of the above, in whatever form or medium.

“Knowledge of Sellers” means the actual knowledge of either or both Owners after reasonable inquiry and diligence with respect to the matters in question.

“Liability” means any liability (whether known or unknown, asserted or unasserted, absolute or contingent, accrued or unaccrued, and whether due, or to become due), including any liability for Taxes and any liability for Title IV Program aid funds received for student living expenses, i.e., a credit balance, but not yet paid to the student.

“License” means any permit, license, contract, agreement, Educational Approval, authorization or other obligation with respect to the College and issued to Sellers by any Governmental Authority or Educational Agency to which Sellers is a party or by which Sellers or the Purchased Assets are bound.

“Lien” has the meaning given that term in Section 3.5 of this Agreement.

| 5 |

“Material Adverse Effect” means: (a) with respect to Sellers, a material adverse effect on (i) the College or Purchased Assets, (ii) the financial condition and results of operations of Sellers, or (iii) the ability of Sellers or Owners to consummate the Transaction or to perform their respective material obligations under this Agreement; and (b) with respect to Buyer, a material adverse effect on the ability of Buyer to consummate the Transaction or to perform its material obligations under this Agreement. “Material Adverse Effect” shall not include any event, occurrence, fact, condition, or change, directly or indirectly, arising out of or attributable to: (A) any changes, conditions or effects in the United States economy or securities or financial markets in general; (B) any change, effect or circumstance resulting from the announcement of this Agreement or the transactions contemplated by this Agreement; or (C) any changes, conditions or effects in the higher education industry in general that does not have a disproportionate effect on Sellers or the College.

“Material Contracts” has the meaning given to that term in Section 3.8 of this Agreement.

“Most Recent Balance Sheet Date” has the meaning given that term in Section 3.4 of this Agreement.

“Ordinary Course of Business” means the ordinary course of the operation of the College consistent with past custom and practice.

“Organizational Documents” means any charter, certificate of formation, articles of organization, articles of incorporation, certificate of incorporation, declaration of partnership, articles of association, code of regulations, bylaws, operating agreement, limited liability company agreement, partnership agreement or similar formation or governing documents and instruments.

“Permitted Liens” means such of the following as to which no enforcement, collection, execution, levy or foreclosure proceeding shall have been commenced and as to which Sellers is not otherwise subject to civil or criminal liability due to its existence: (a) liens for Taxes not yet due and payable as of the Closing Date; (b) materialmen’s, mechanics’, carriers’, workmen’s and repairmen’s liens and other similar liens arising in the Ordinary Course of Business for amounts which are not yet due and payable and which are not, individually or in the aggregate, material to the College or the Purchased Assets; and (c) zoning laws and ordinances, reciprocal easement agreements and other customary encumbrances on or defects in title that are of record to real or personal property that (i) were not incurred in connection with any indebtedness, (ii) do not render title to the property encumbered thereby unmarketable, (iii) do not, individually or in the aggregate, materially adversely affect the value, use or occupancy of such property for its current and anticipated purposes, and (iv) are not, individually or in the aggregate, material to the College or the Purchased Assets.

“Purchase Price” has the meaning given that term in Section 2.3 of this Agreement.

“Person” means an individual, corporation, limited liability company, partnership, trust, unincorporated association or any other entity or organization.

| 6 |

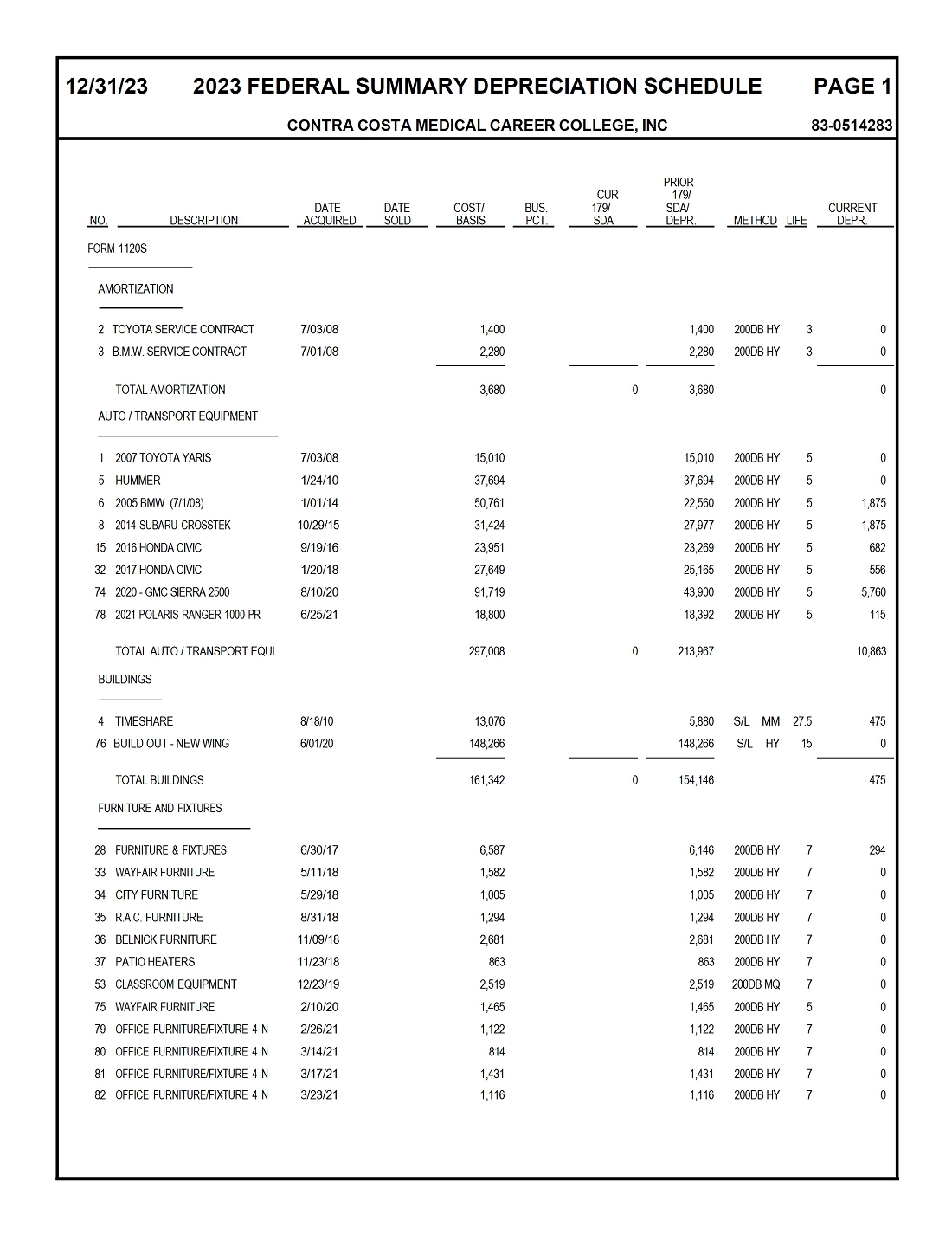

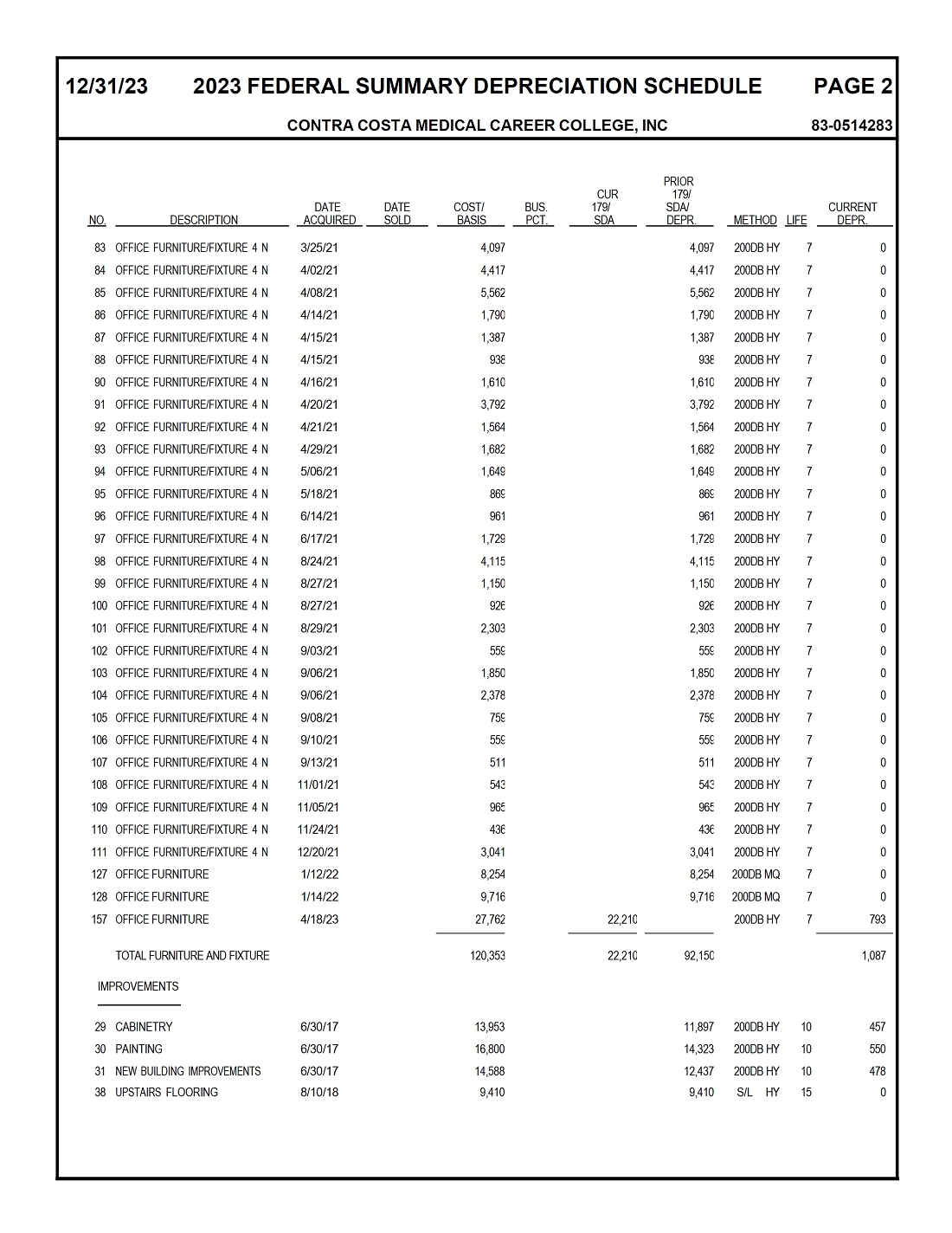

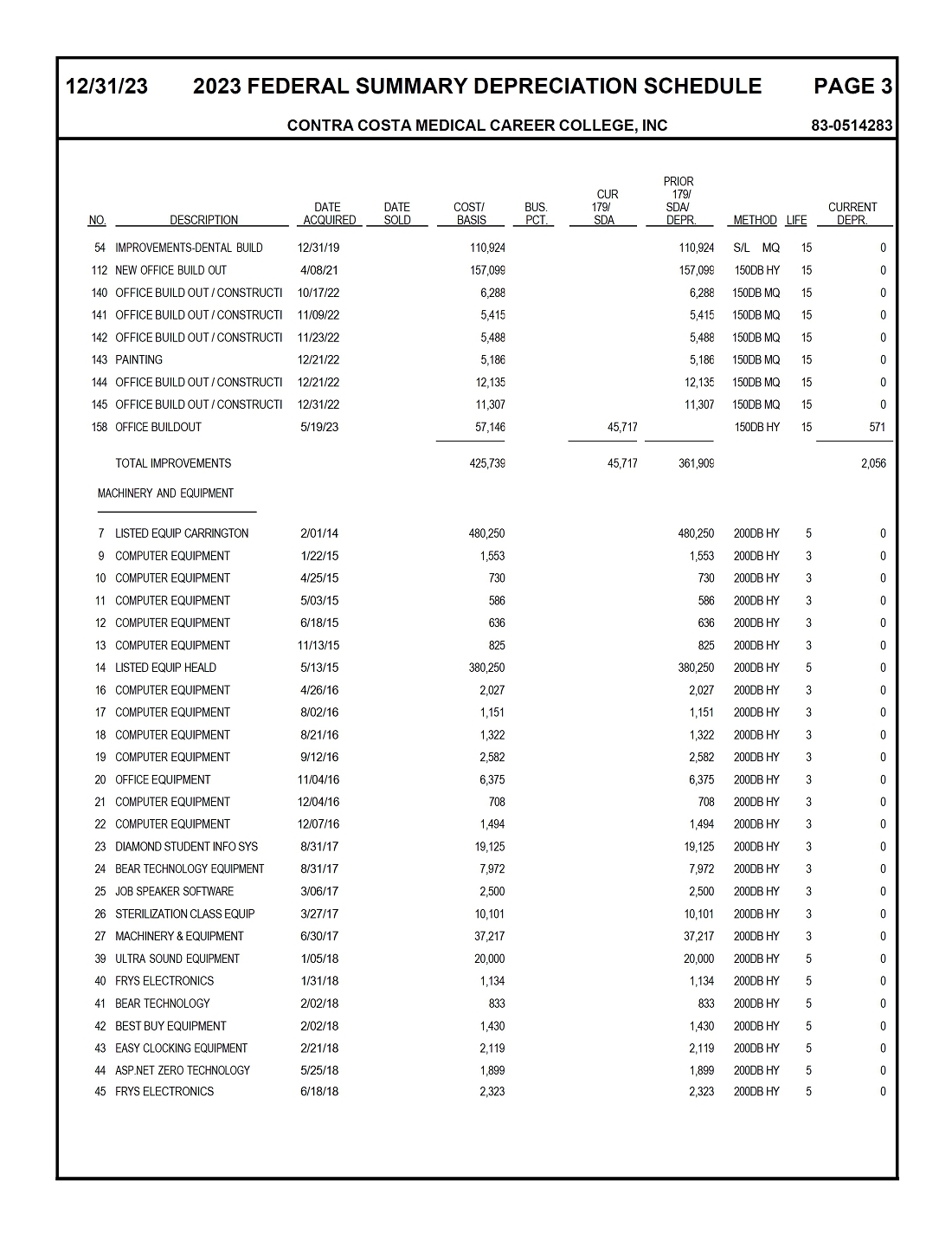

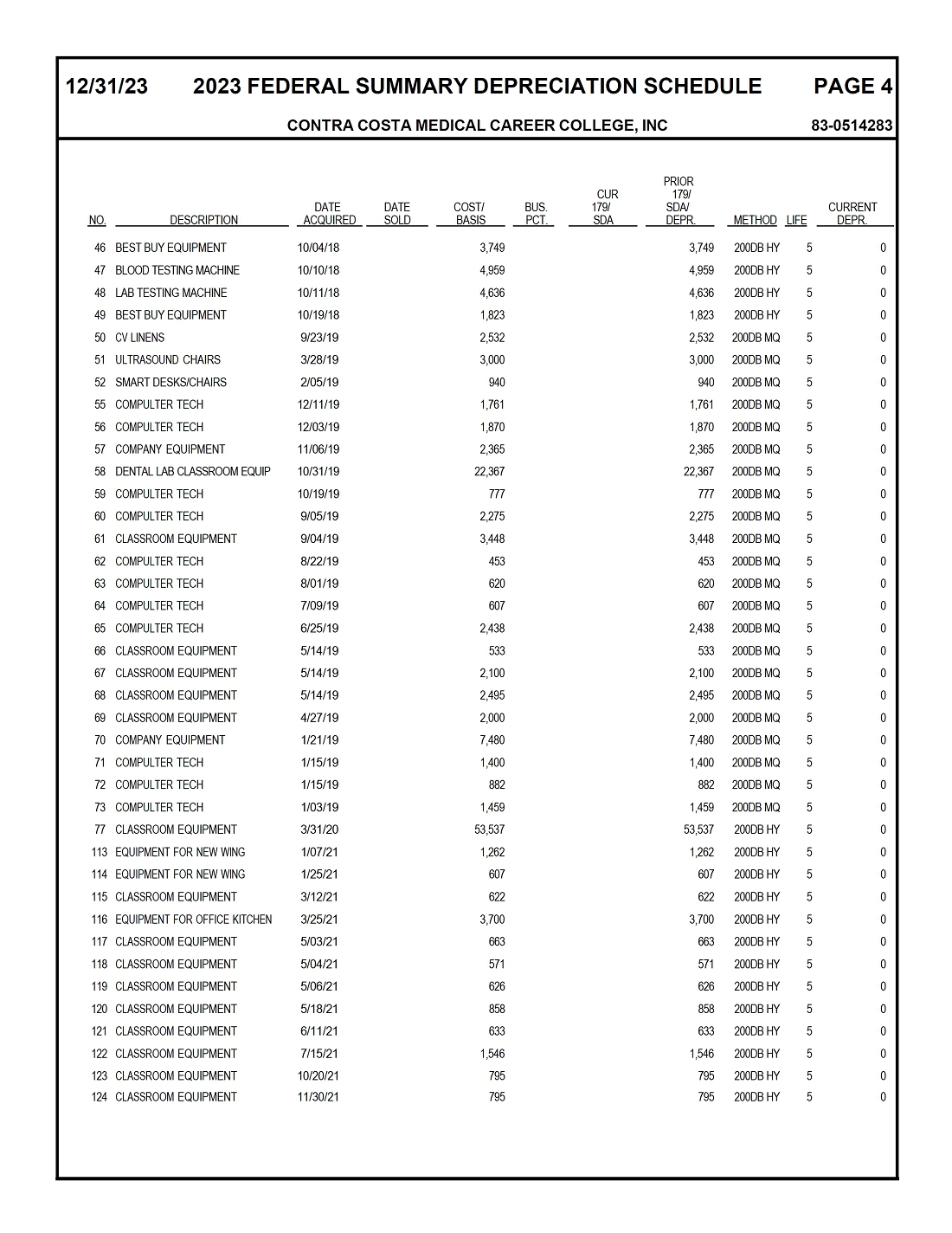

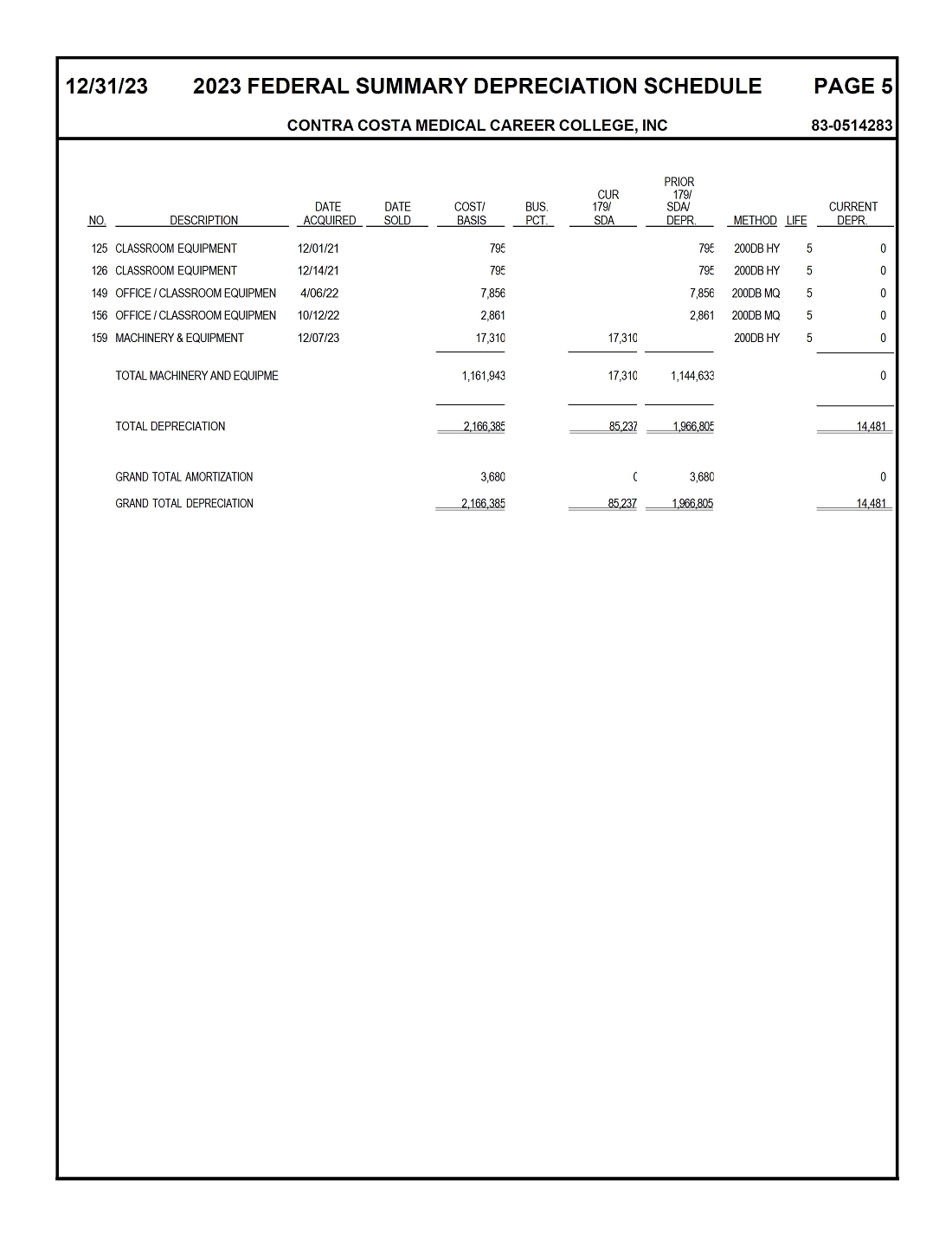

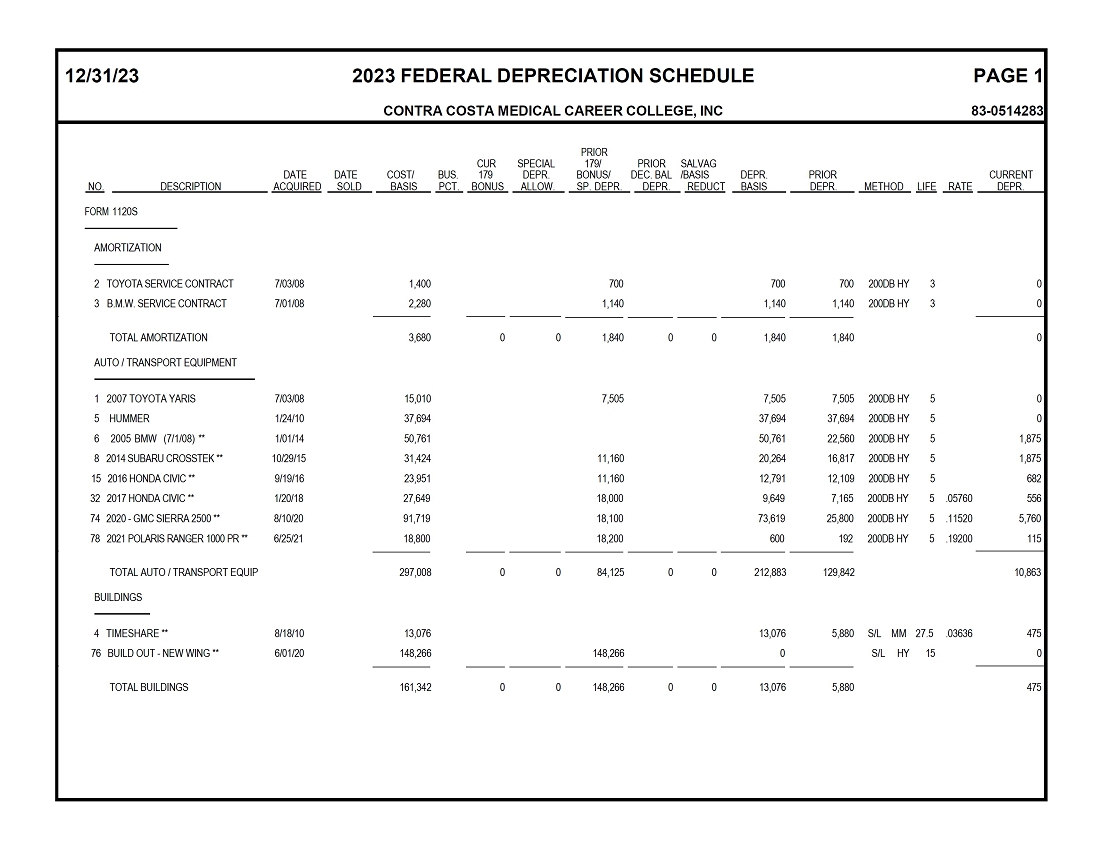

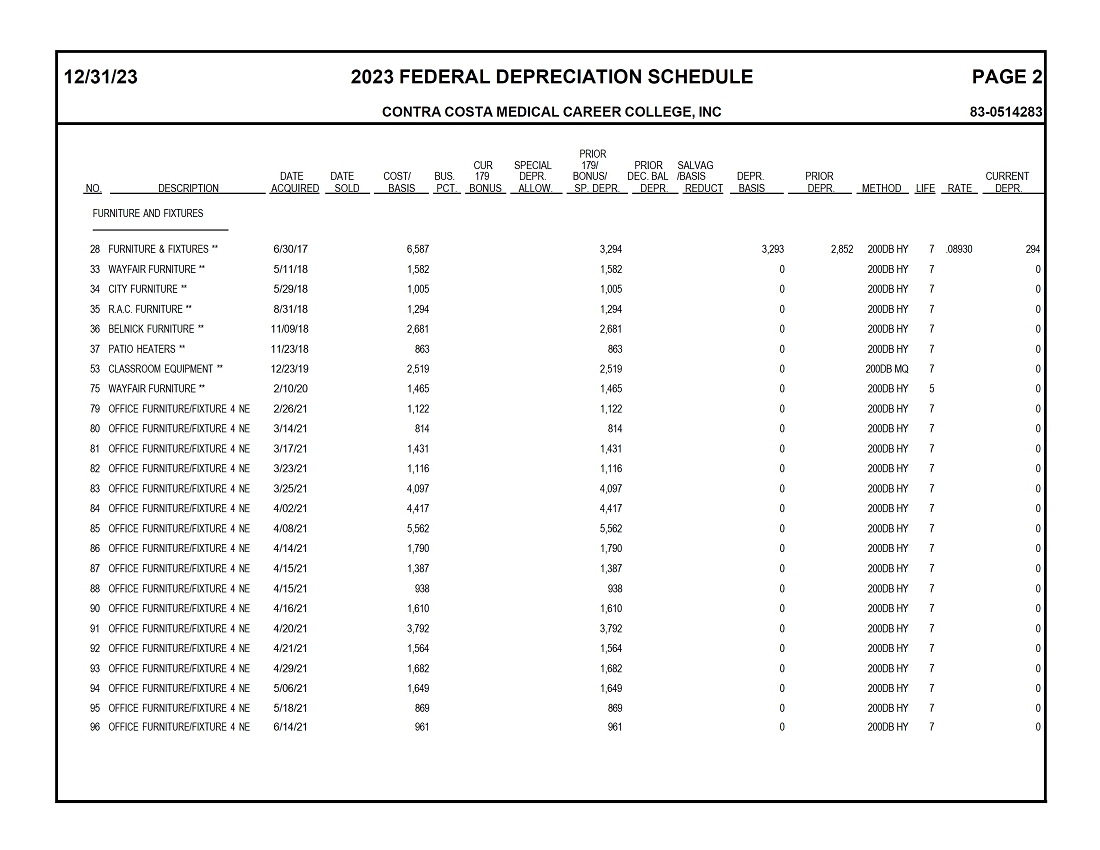

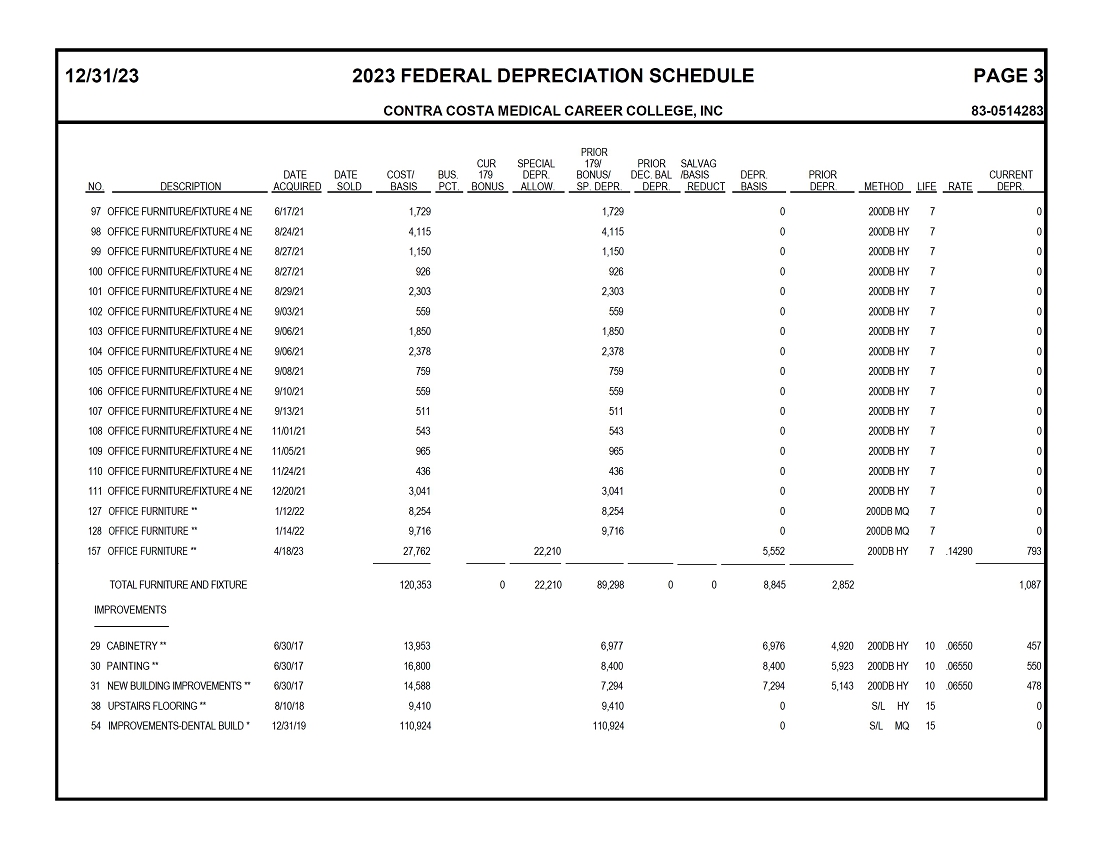

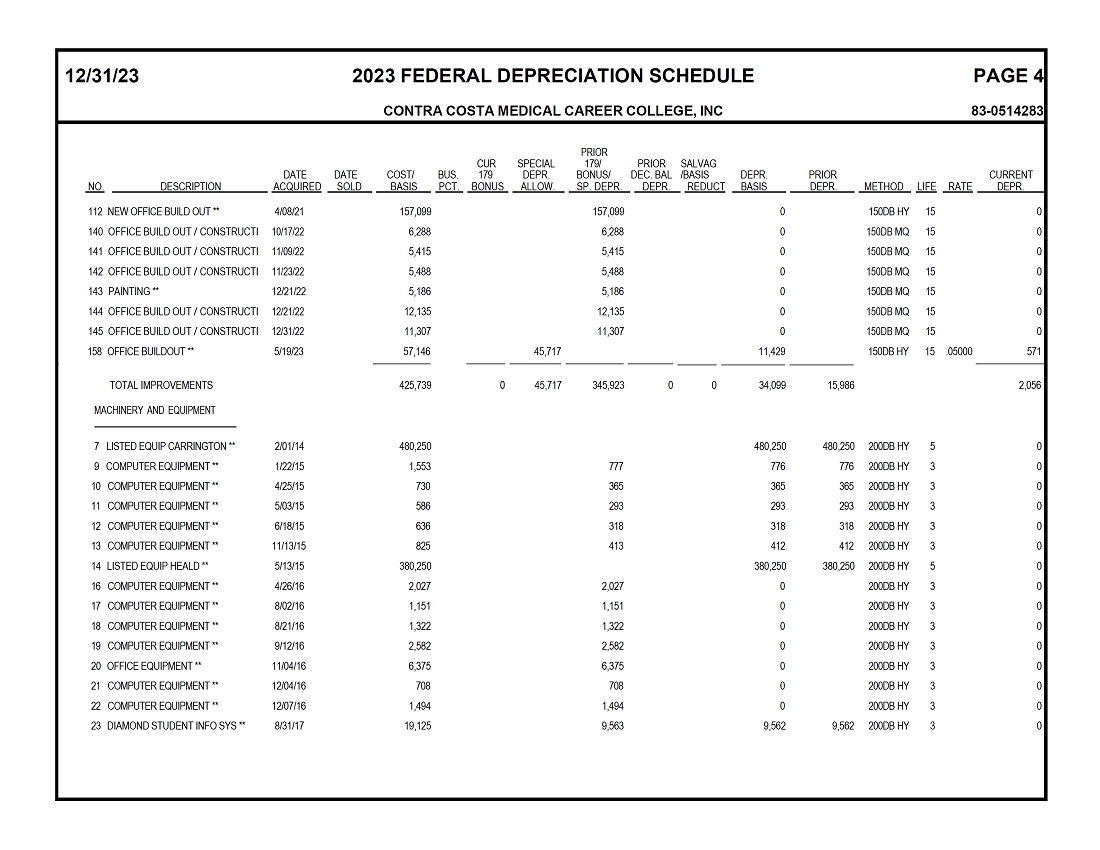

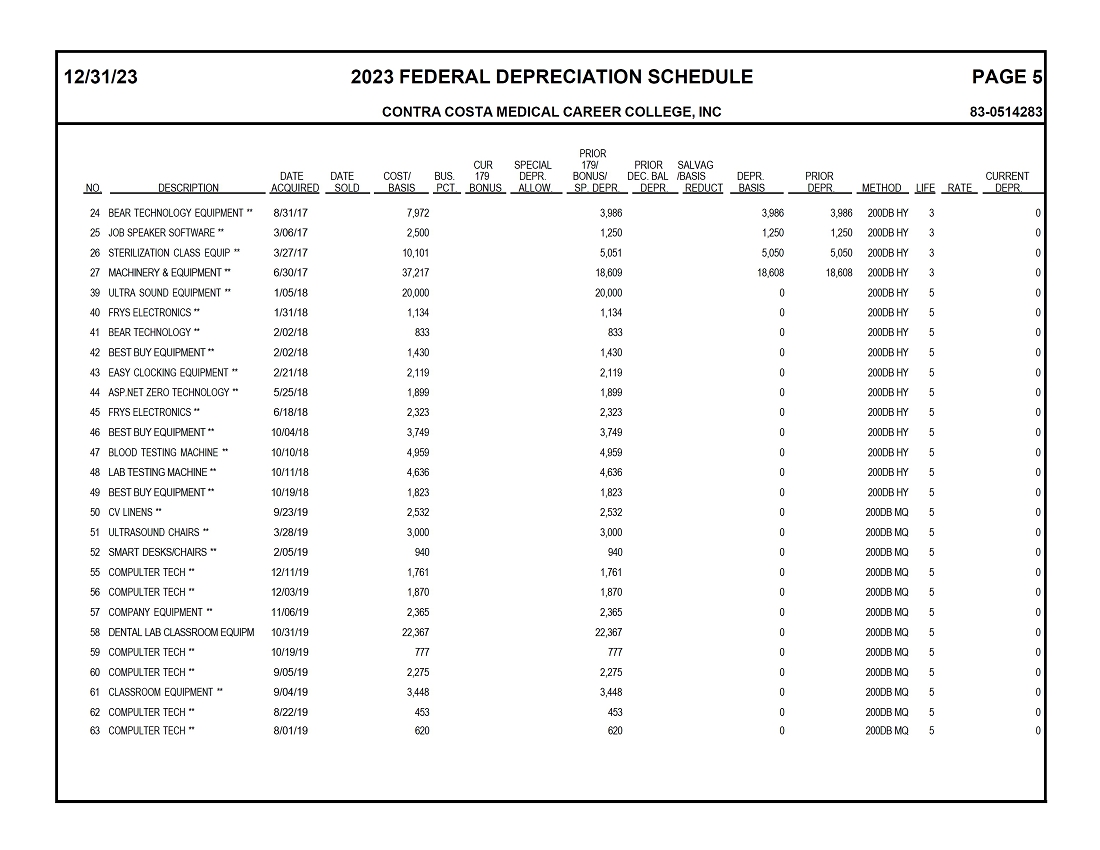

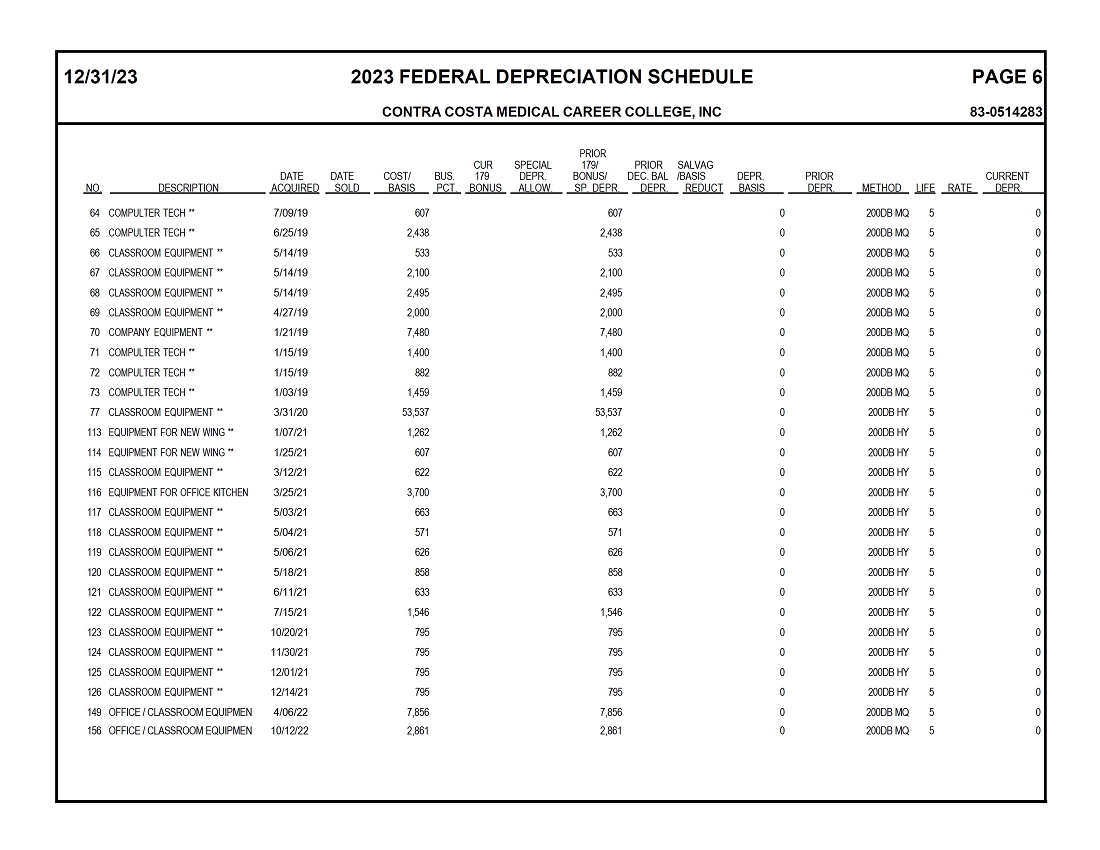

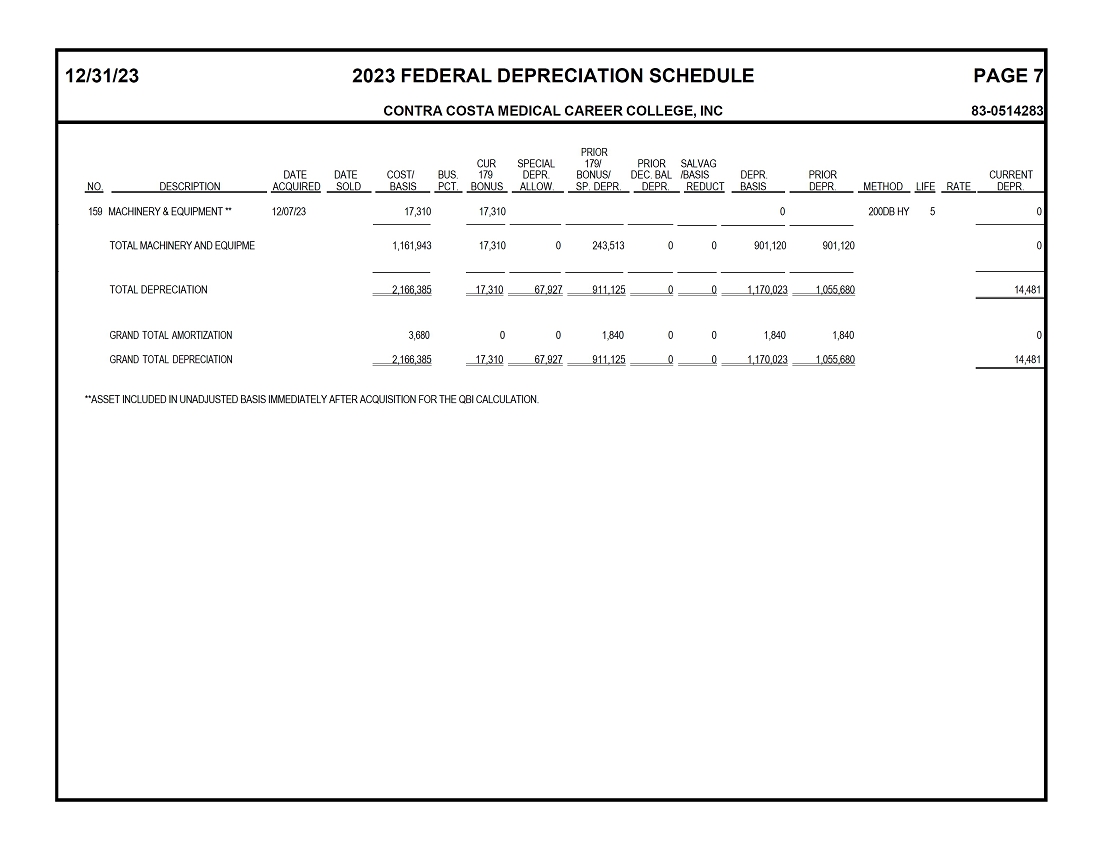

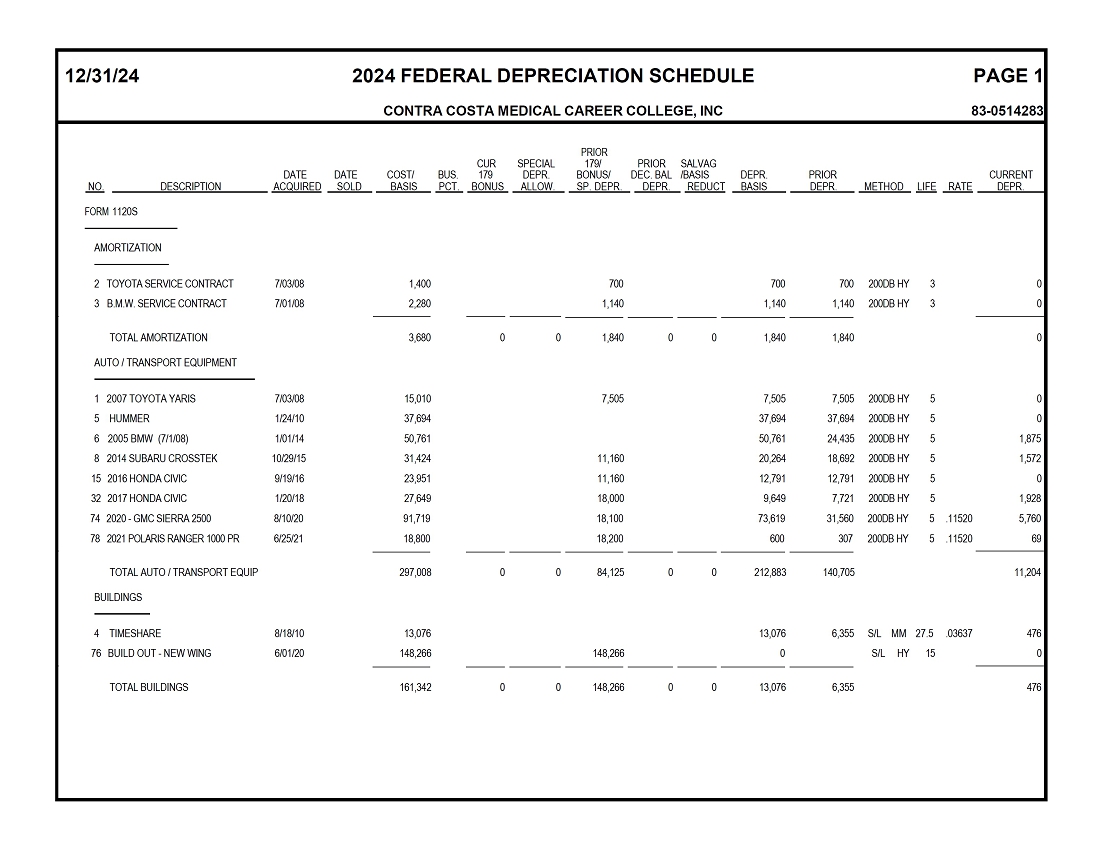

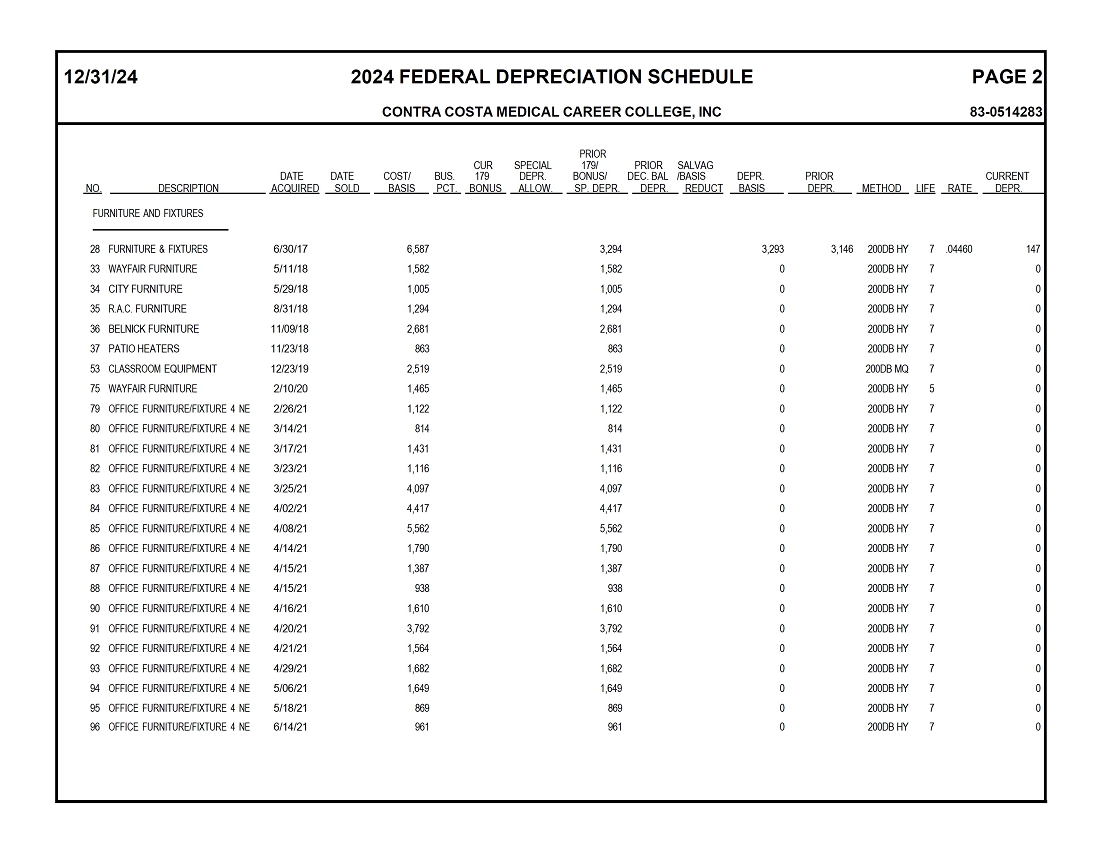

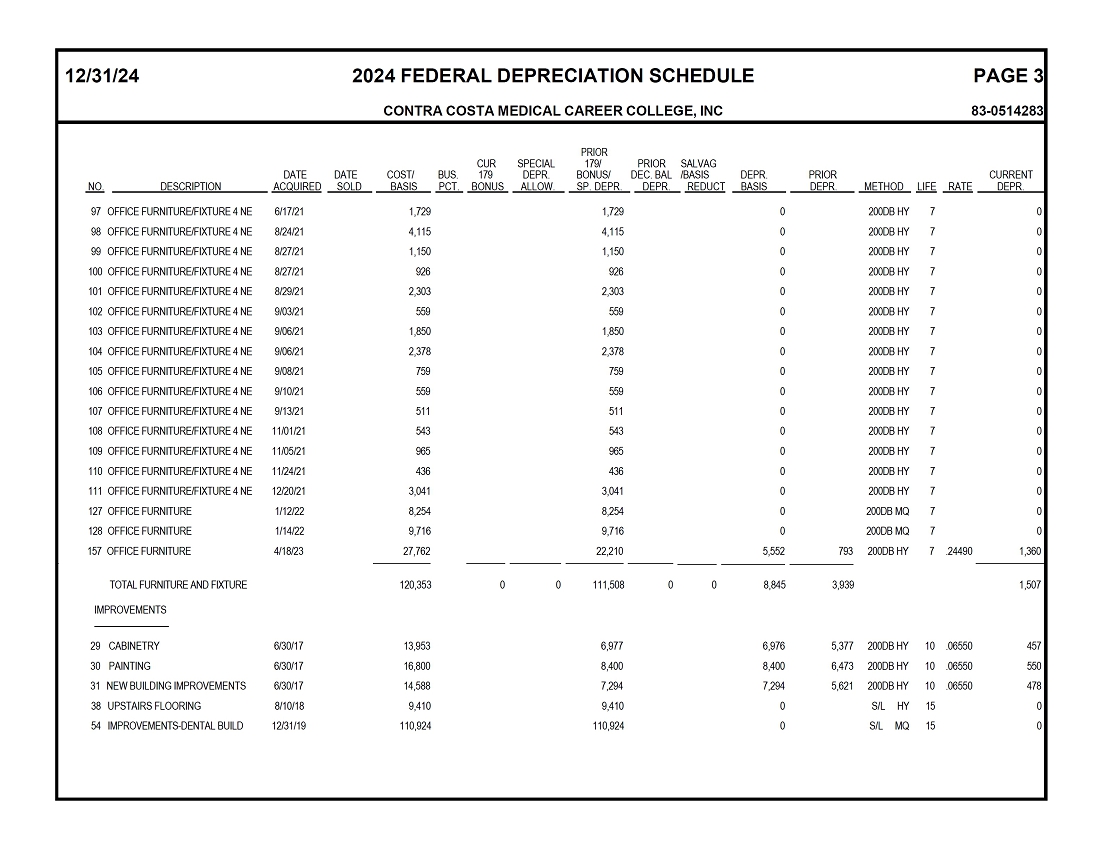

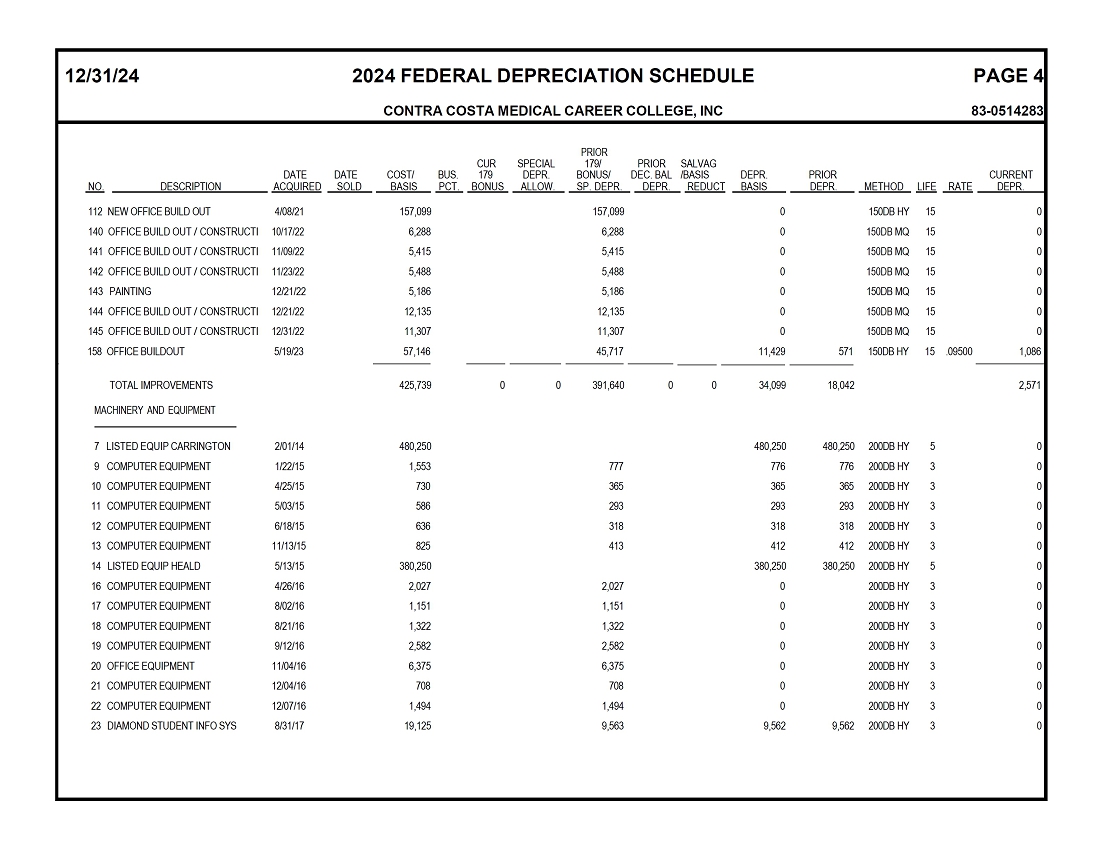

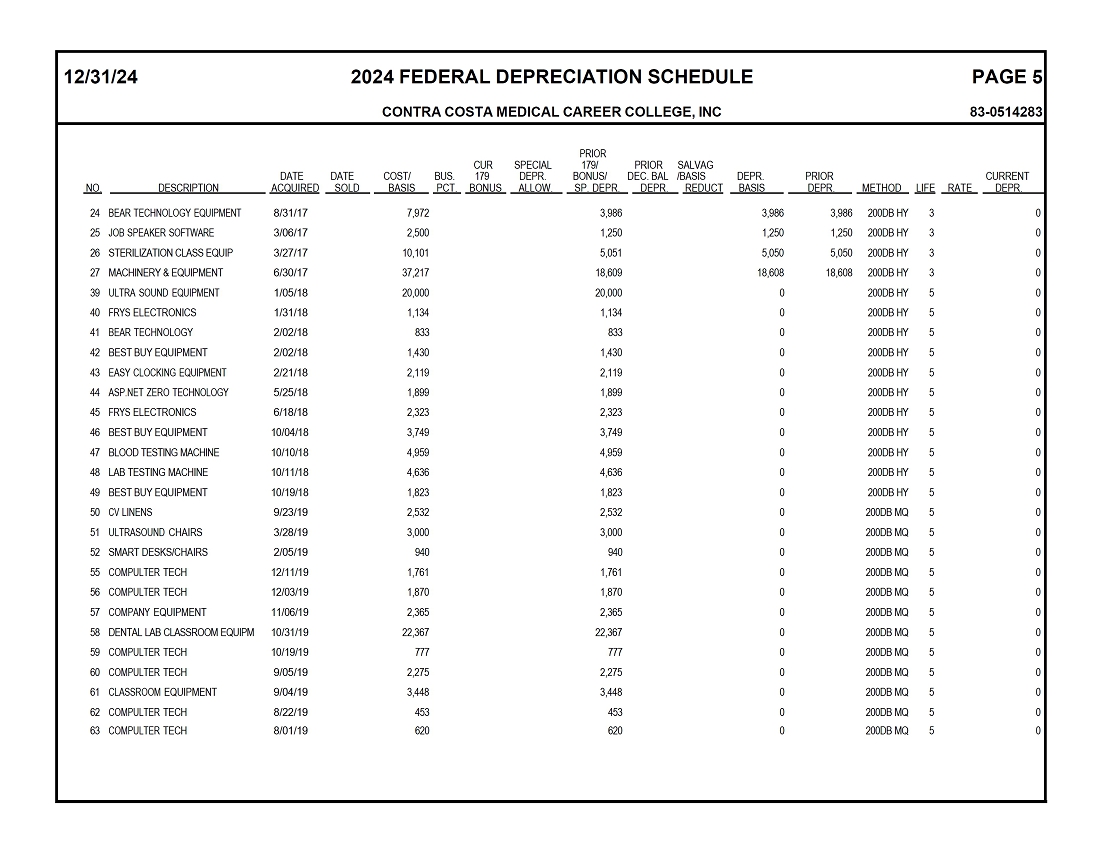

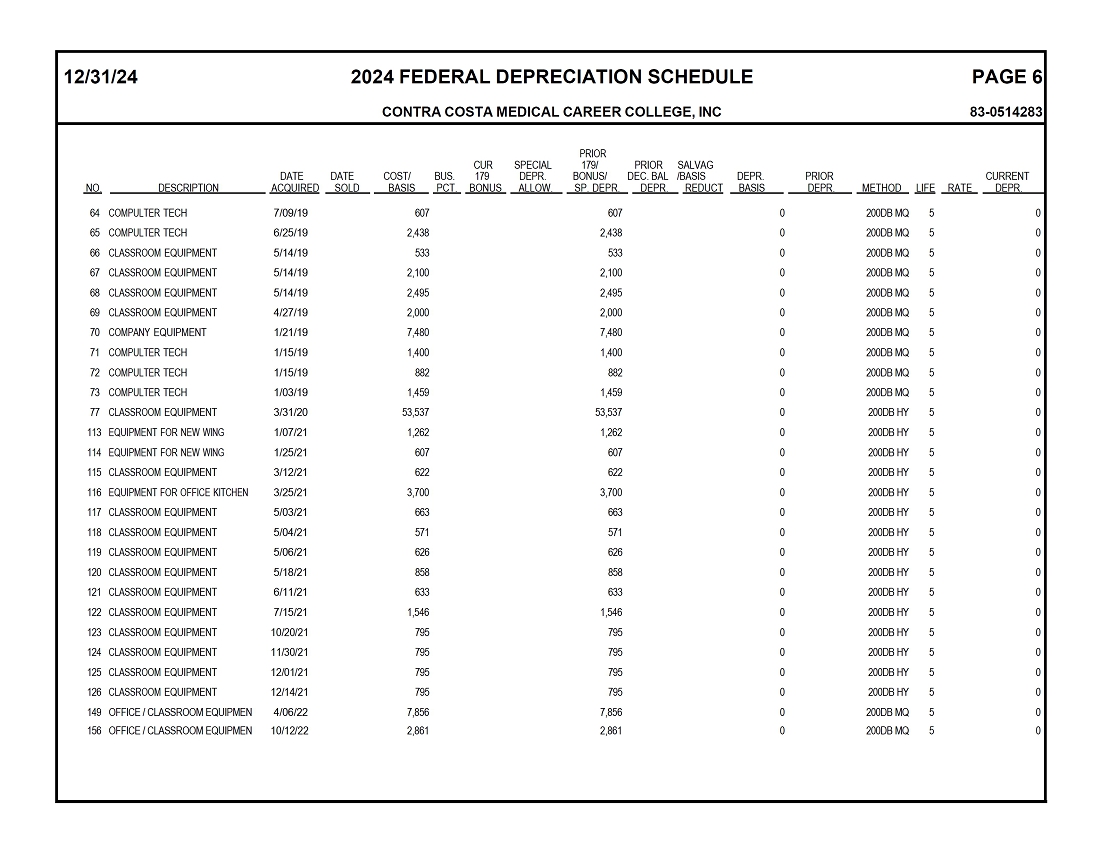

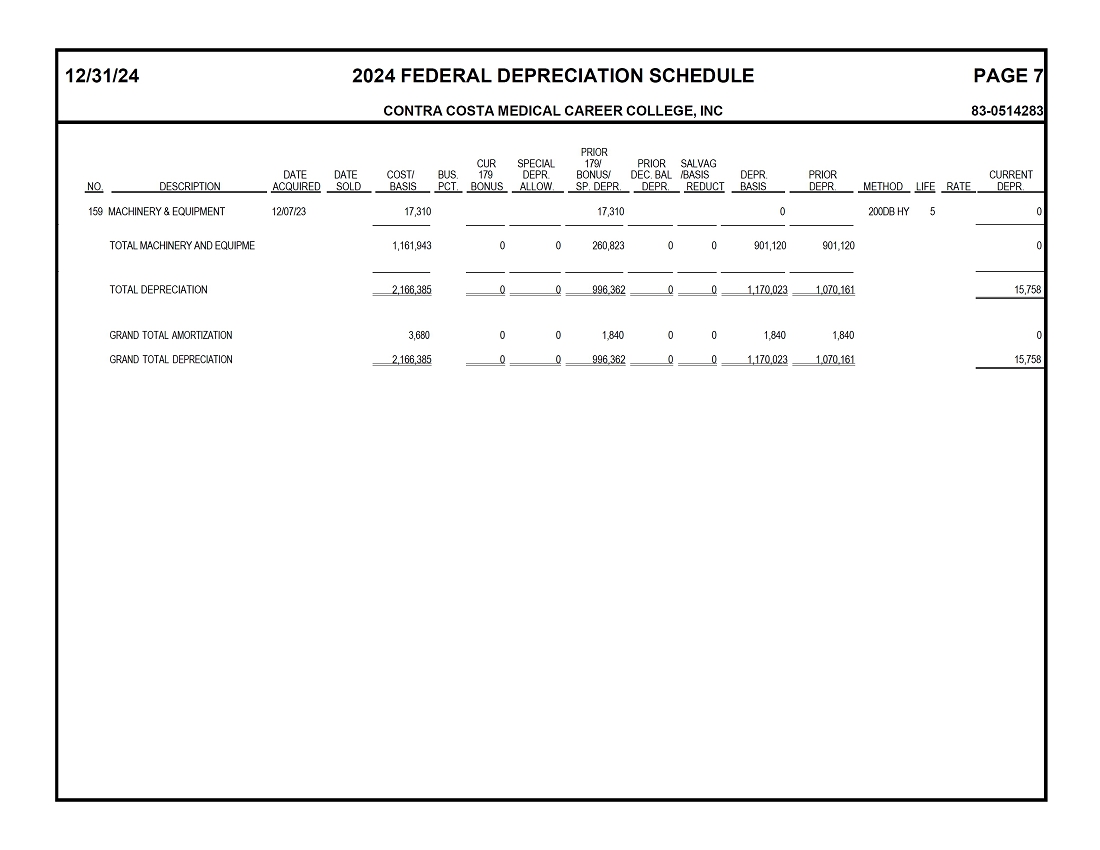

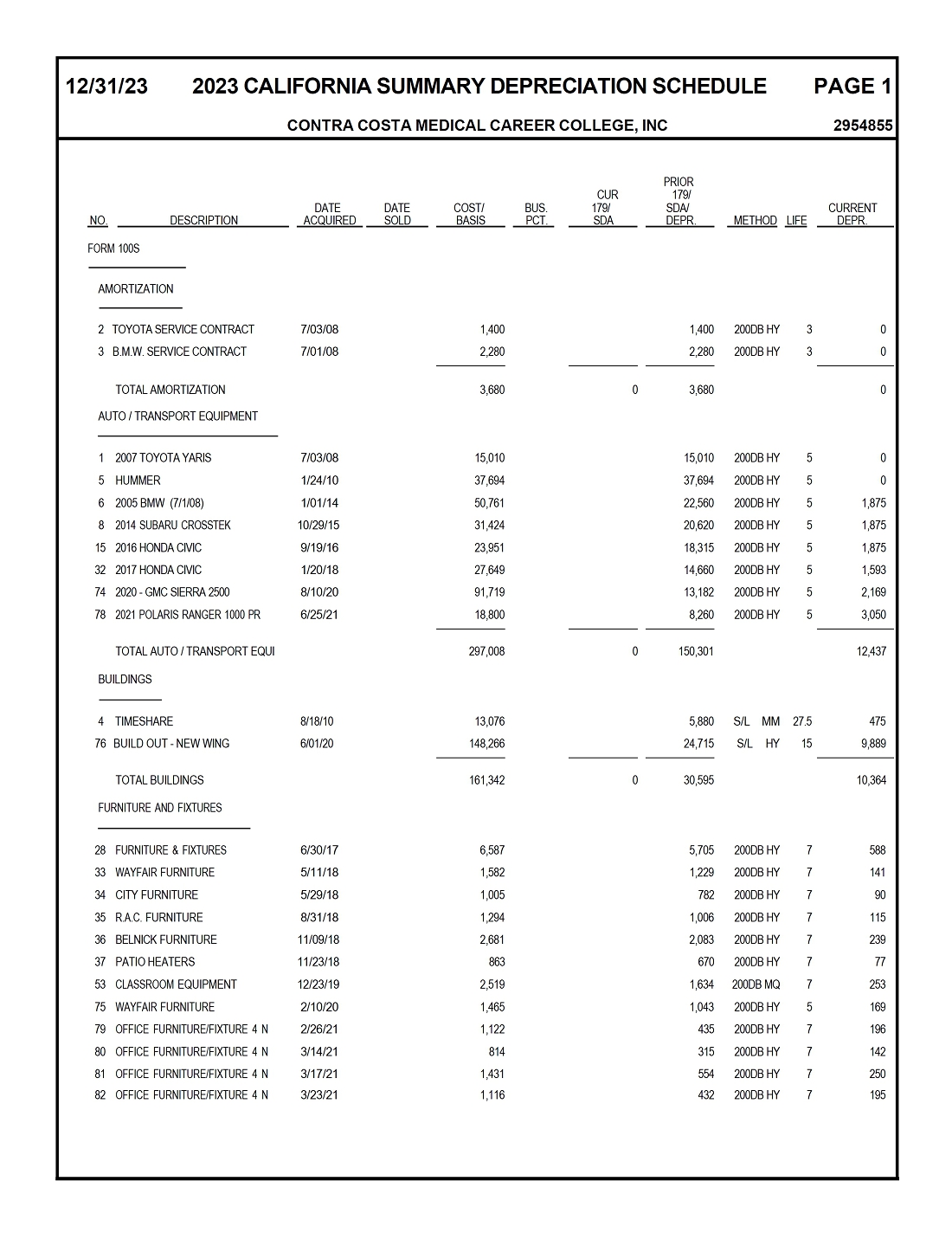

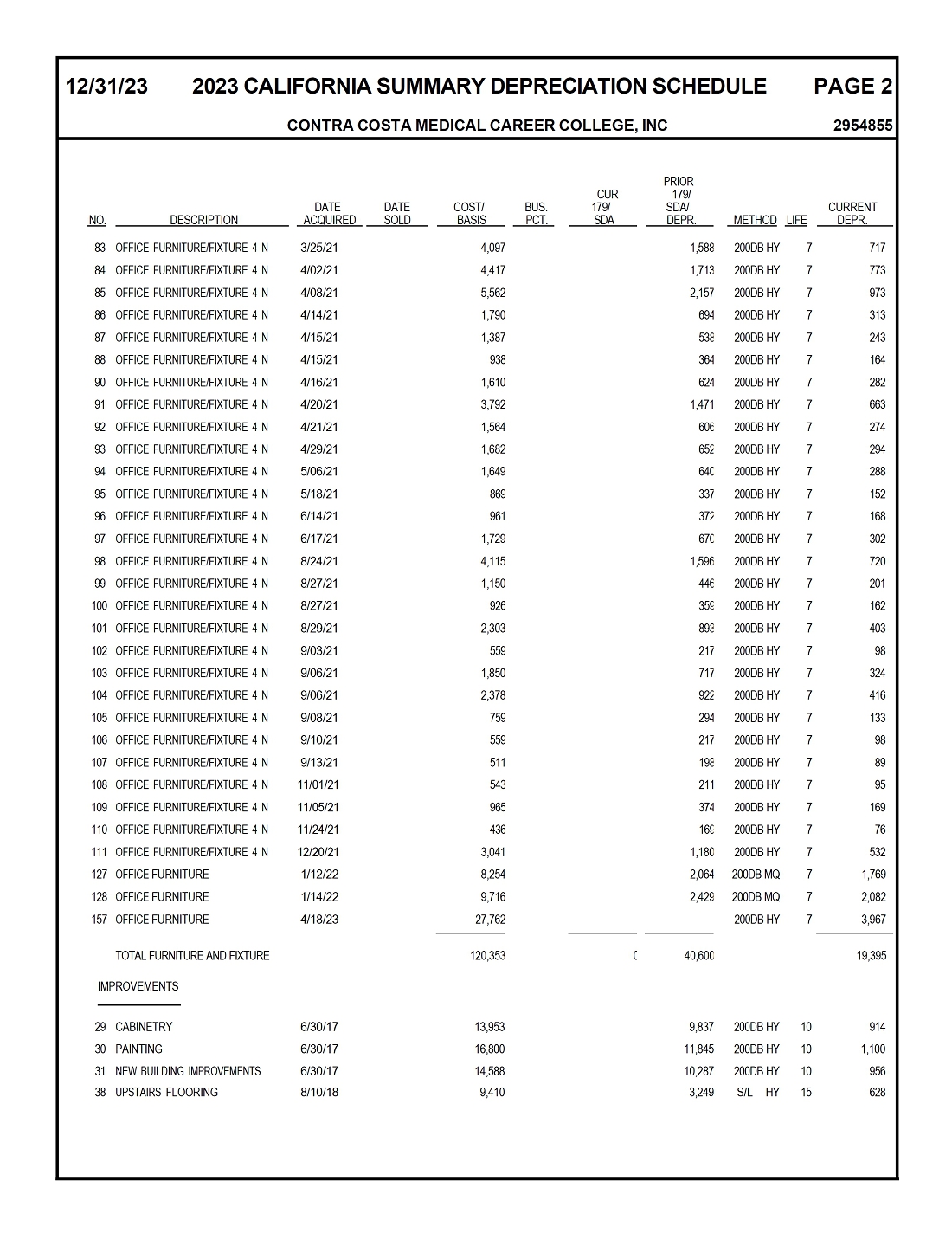

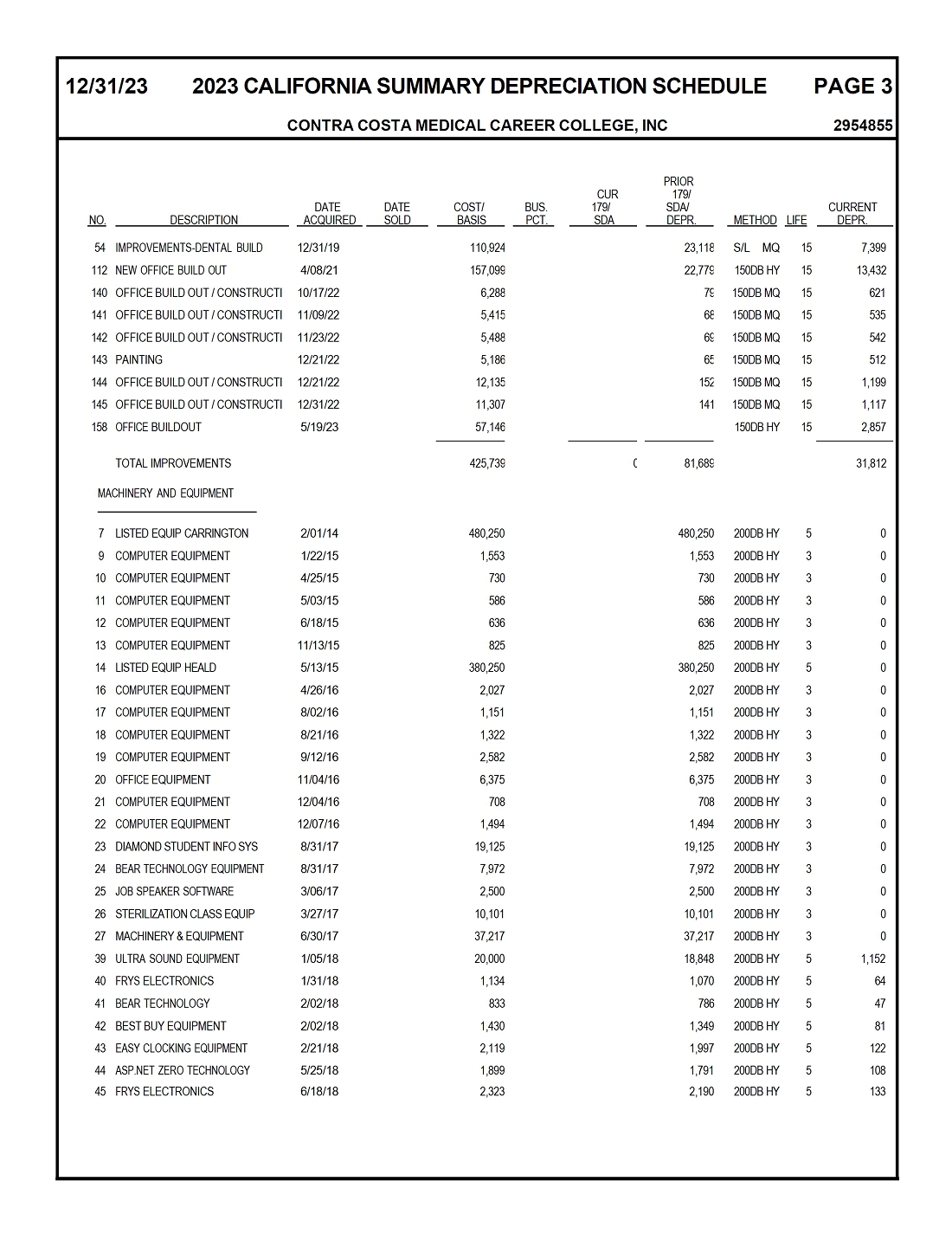

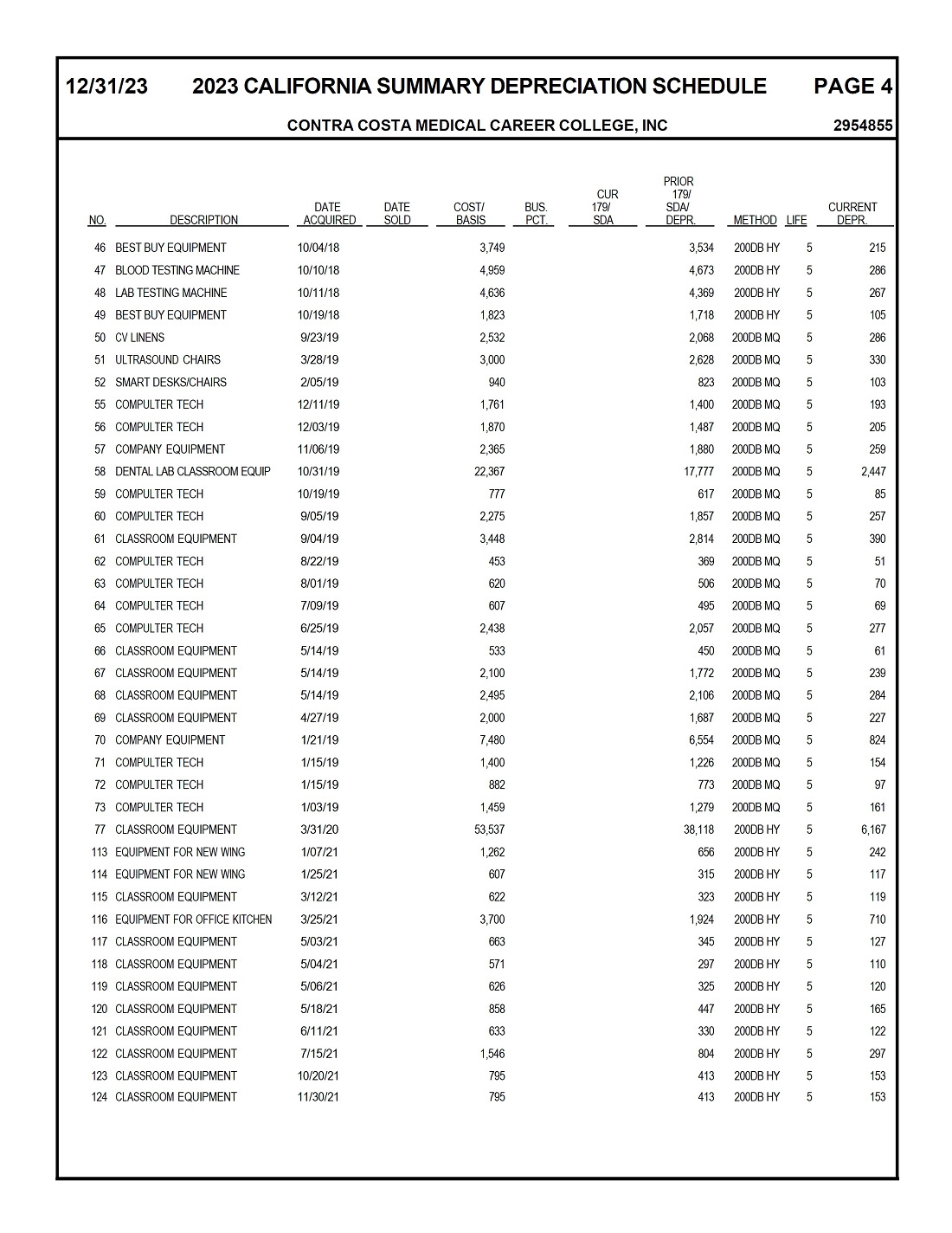

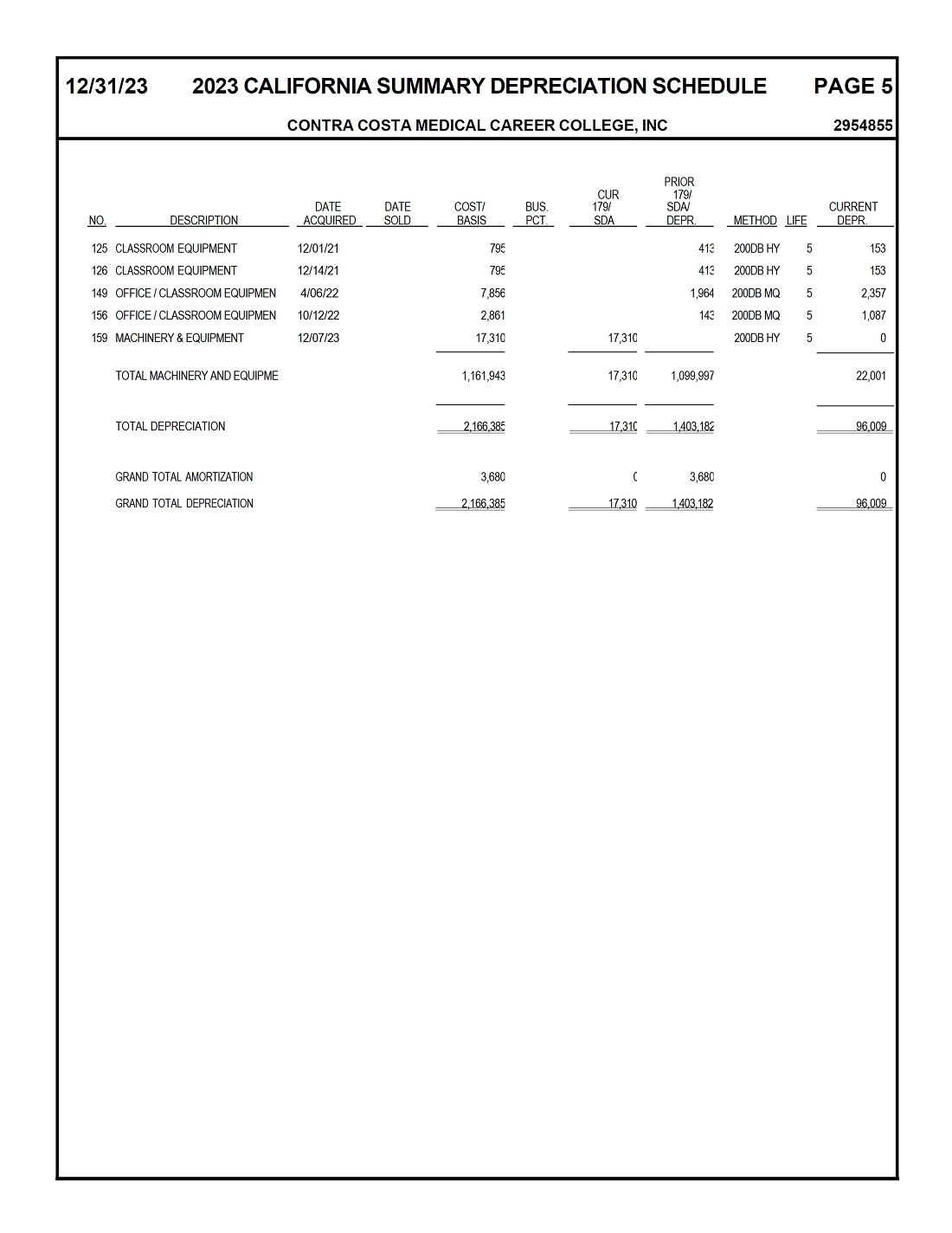

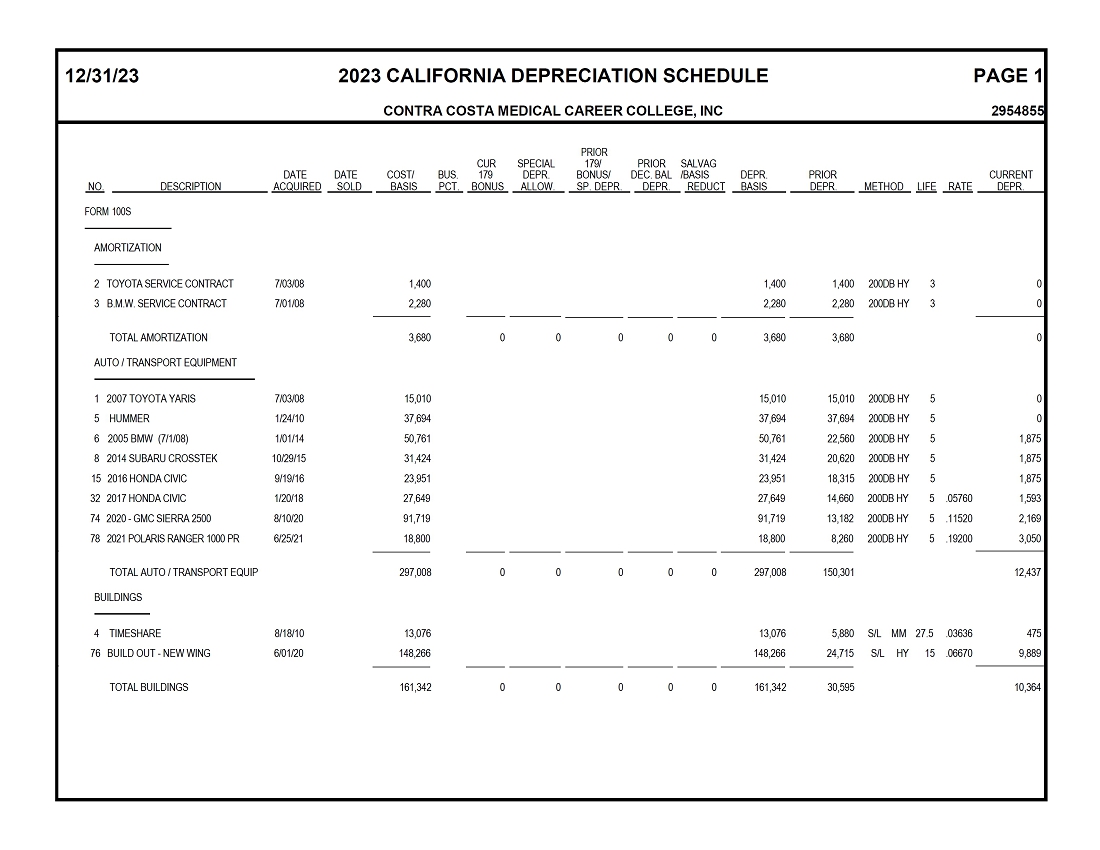

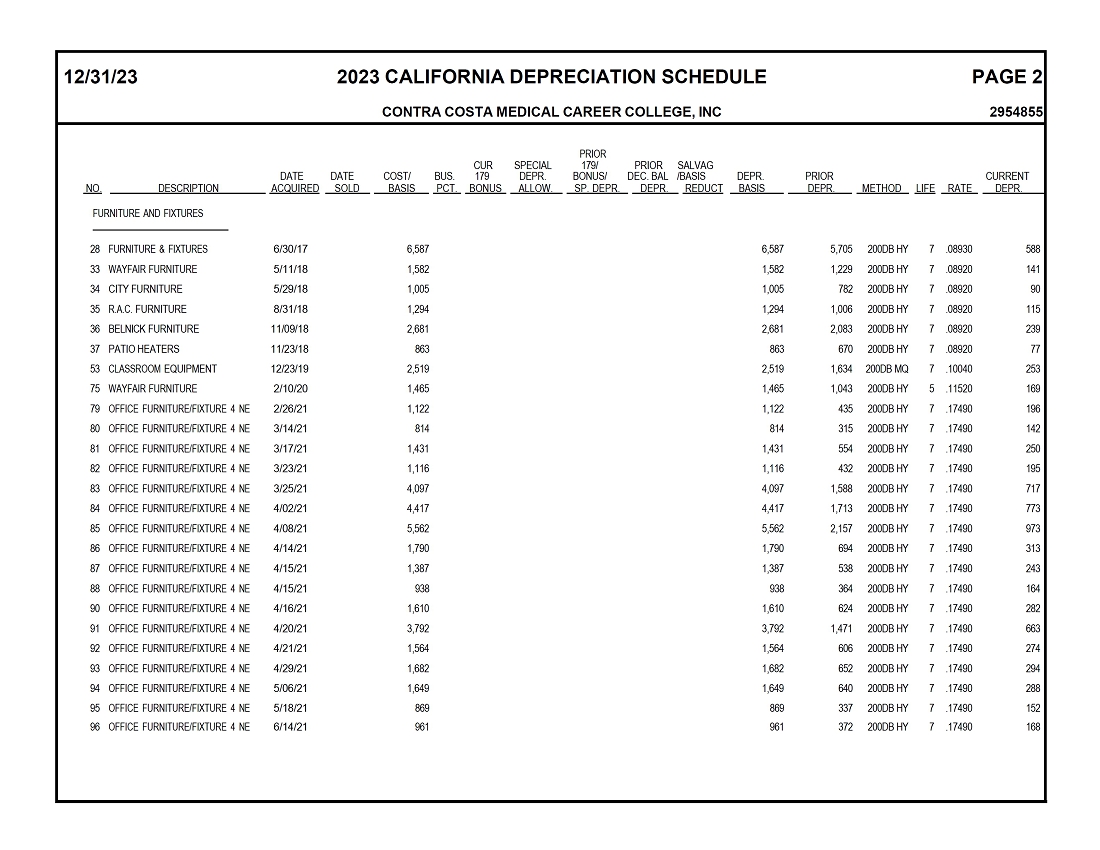

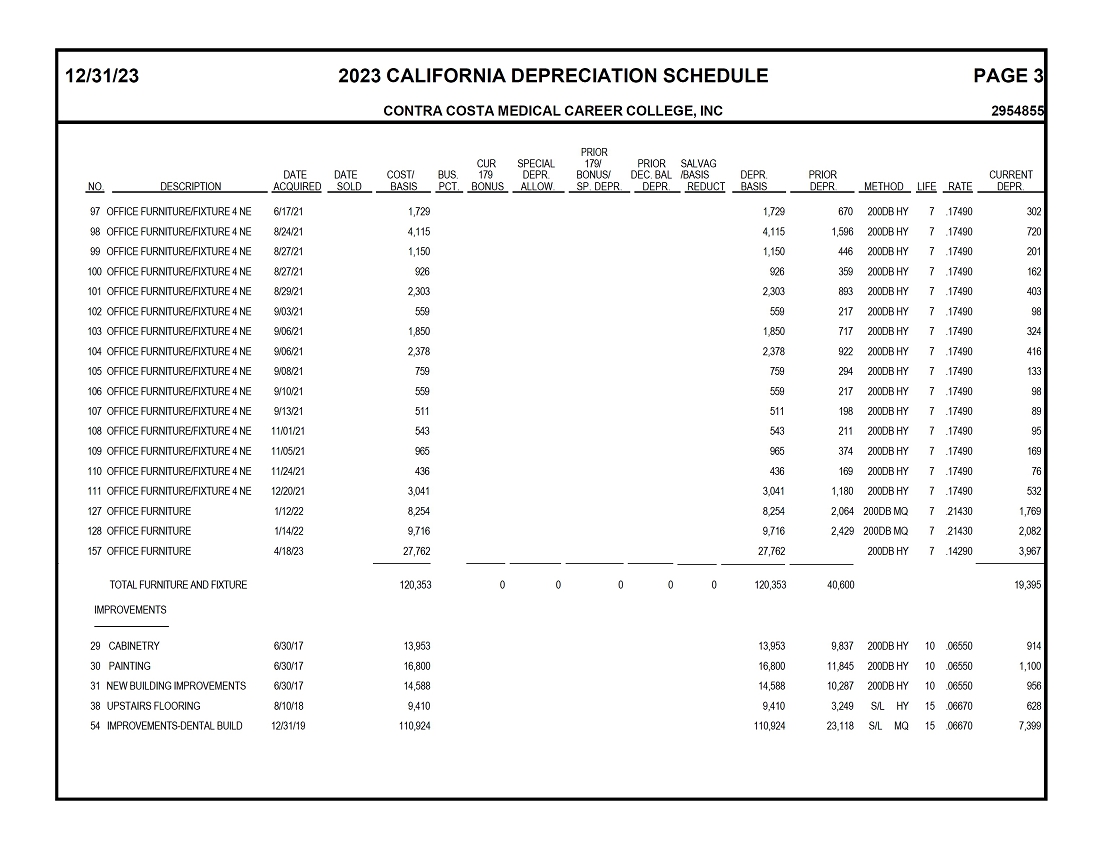

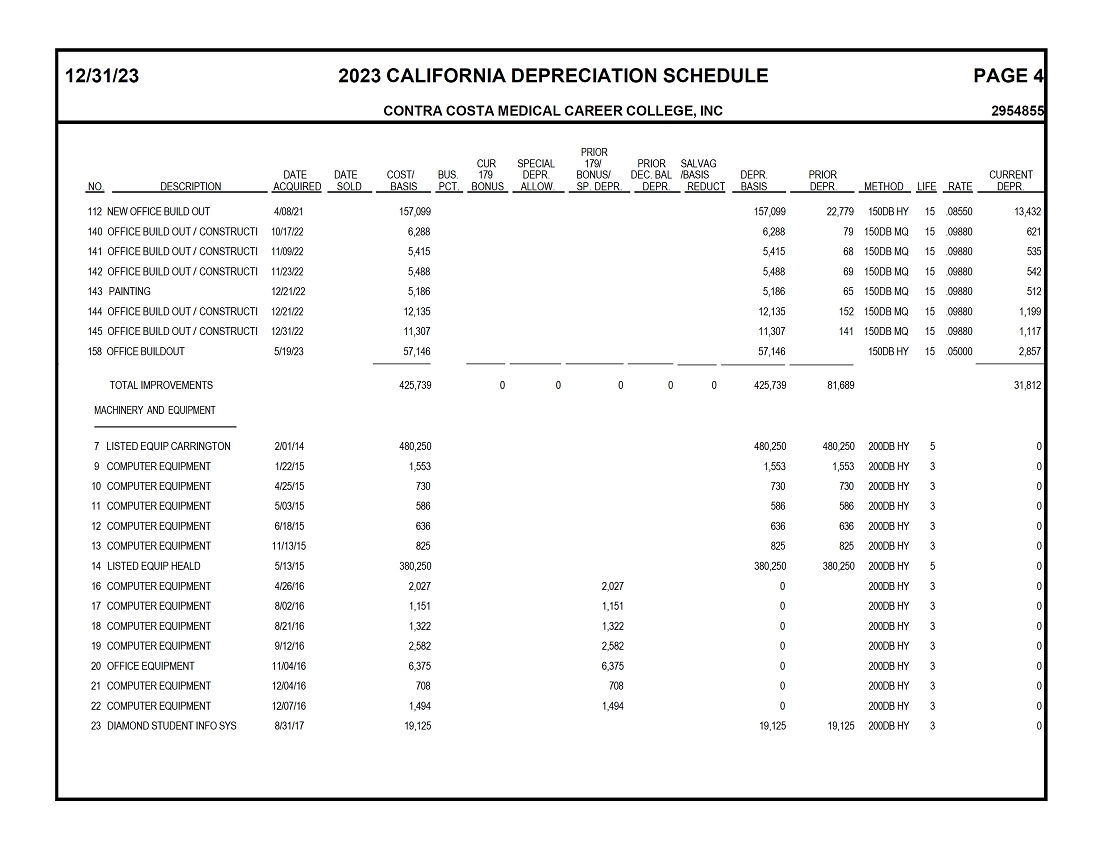

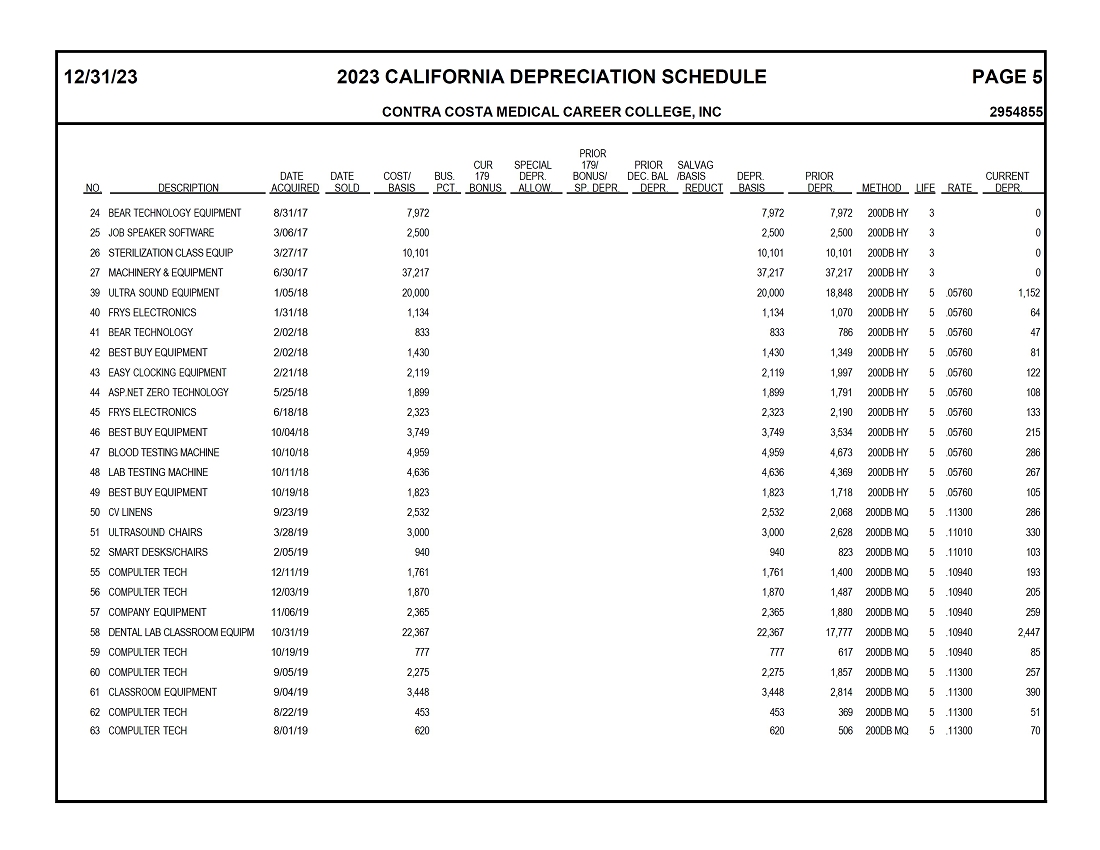

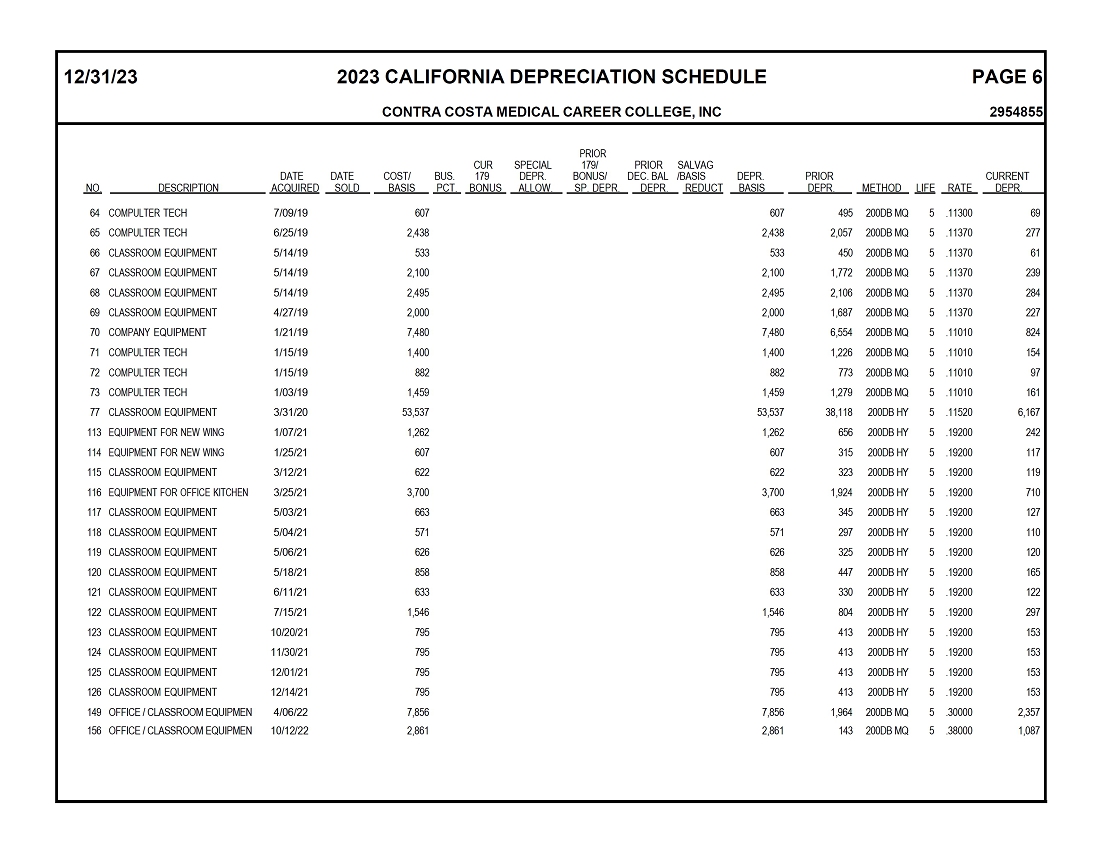

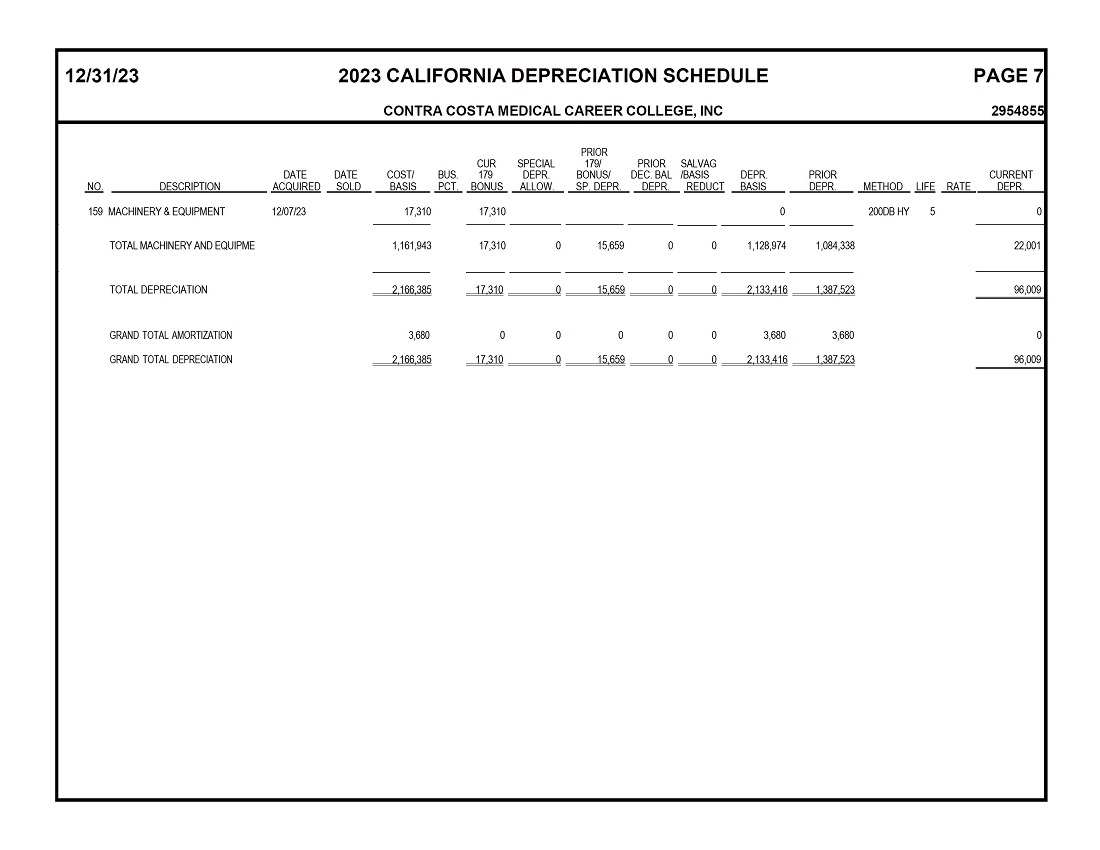

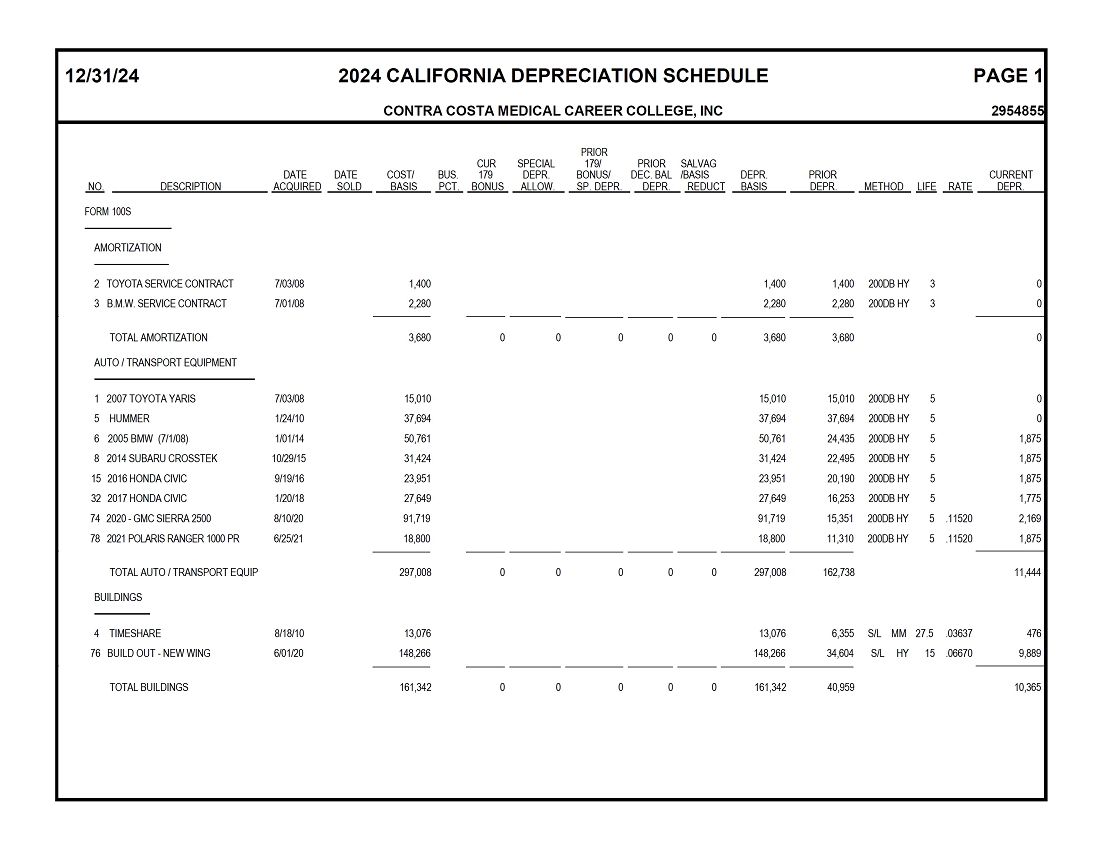

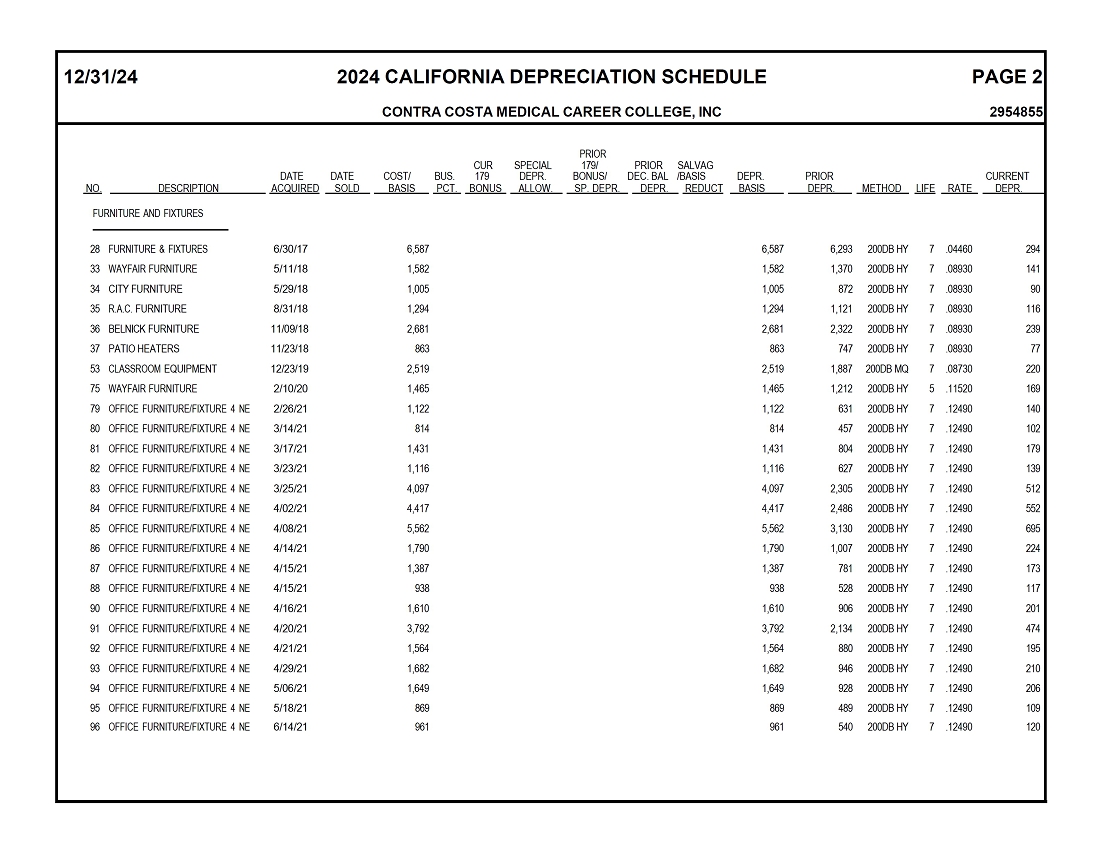

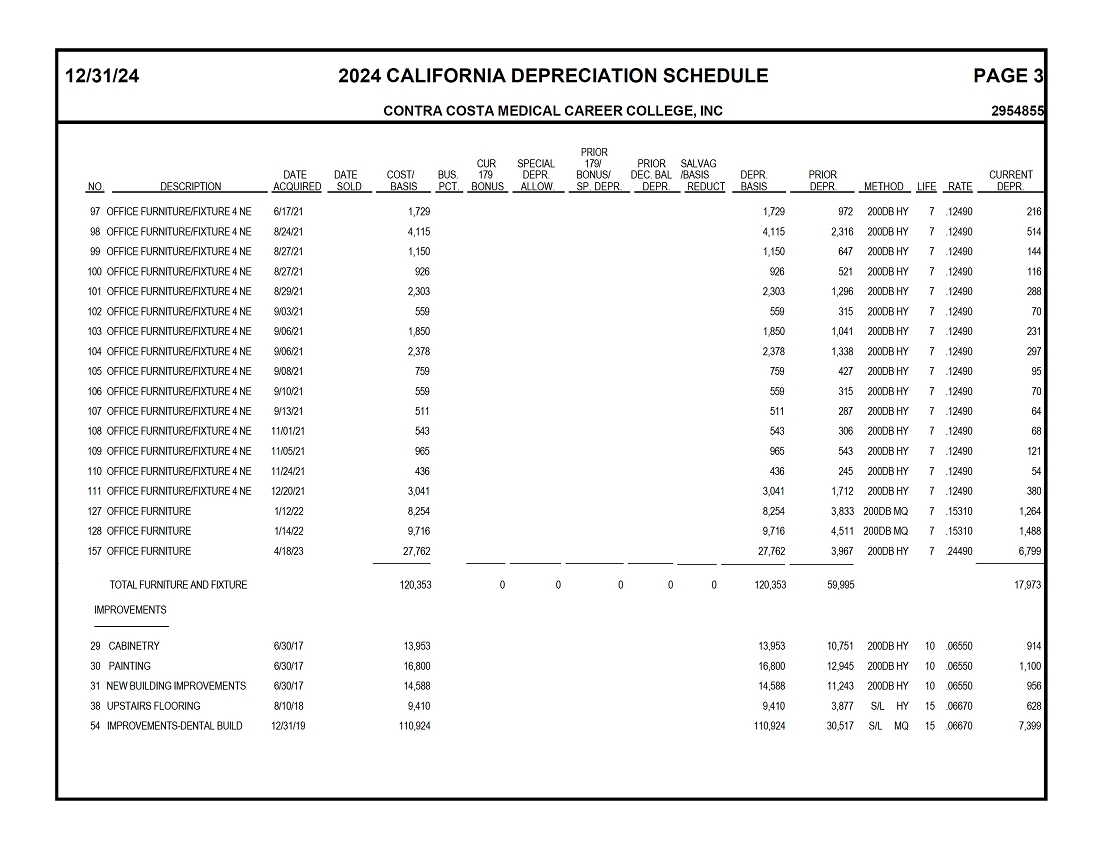

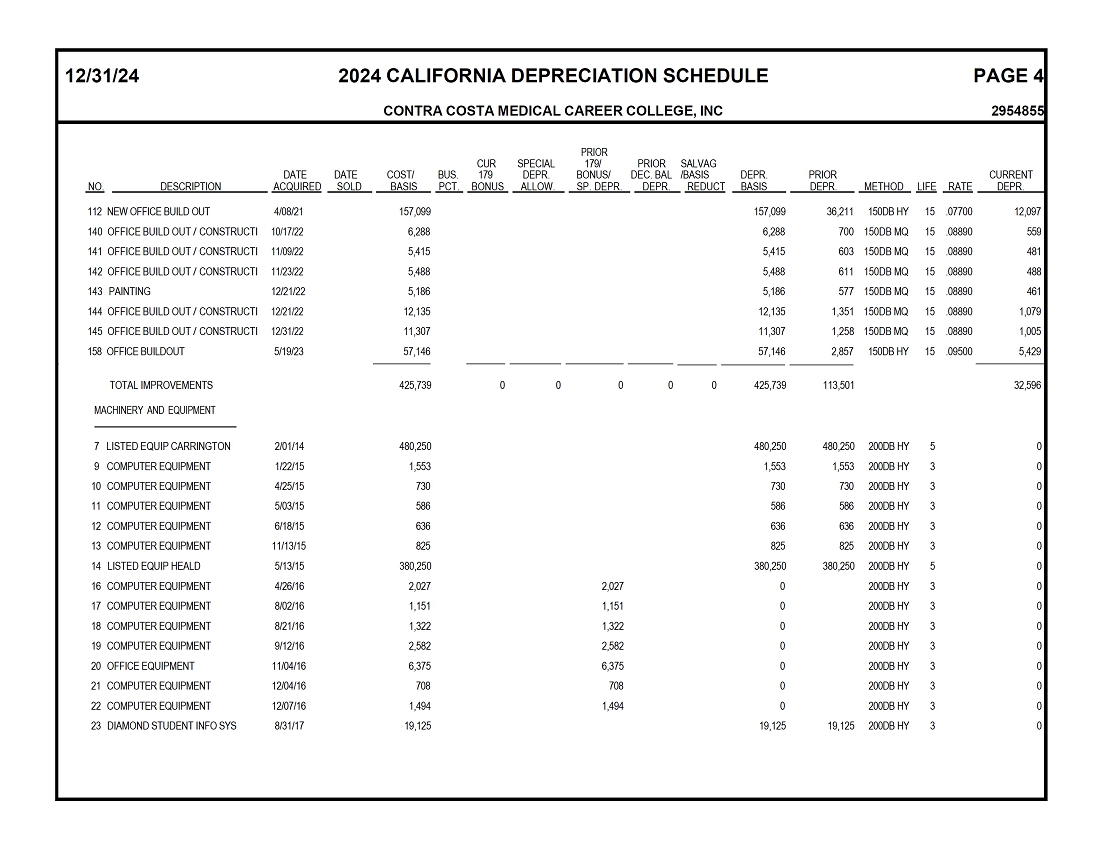

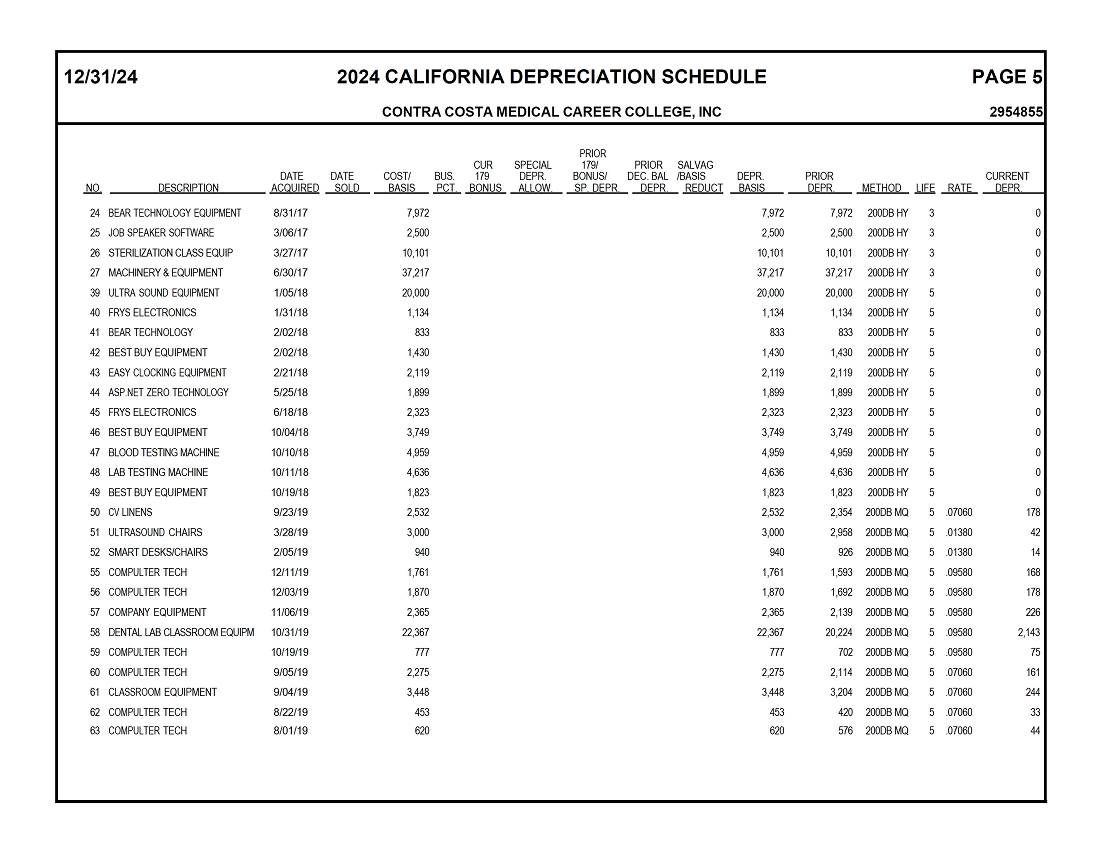

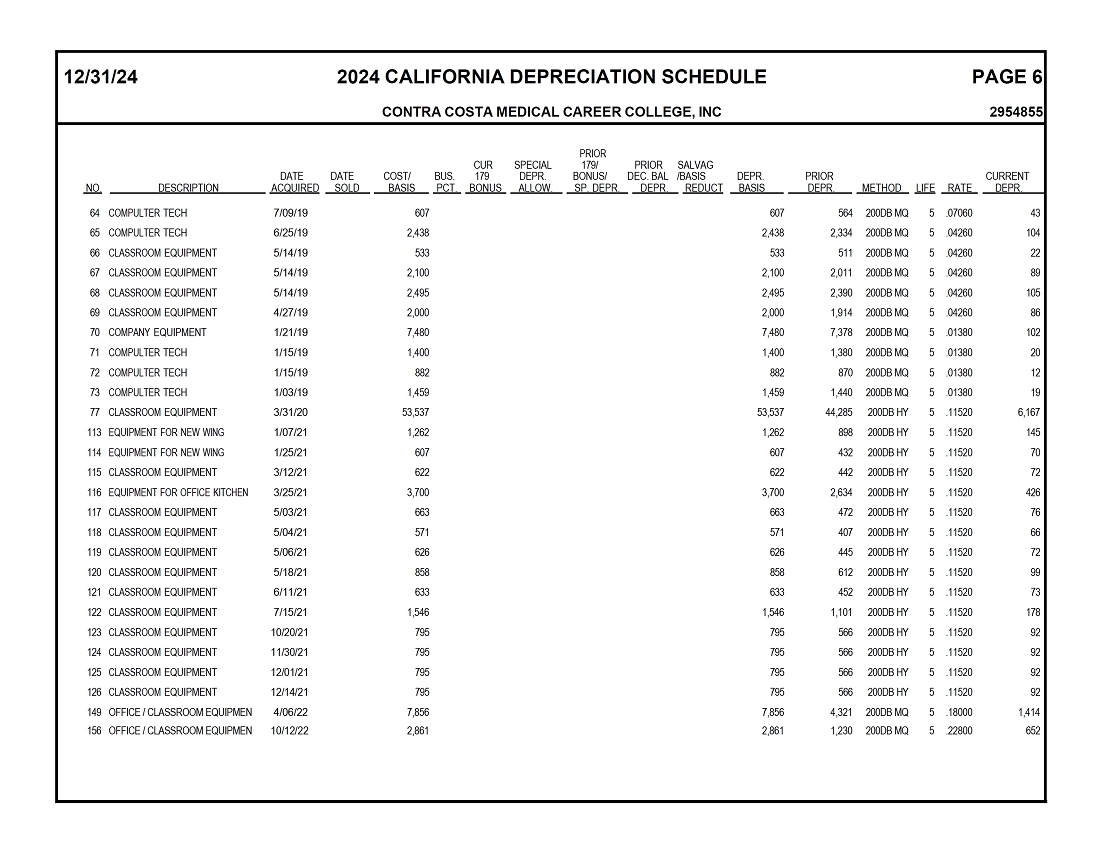

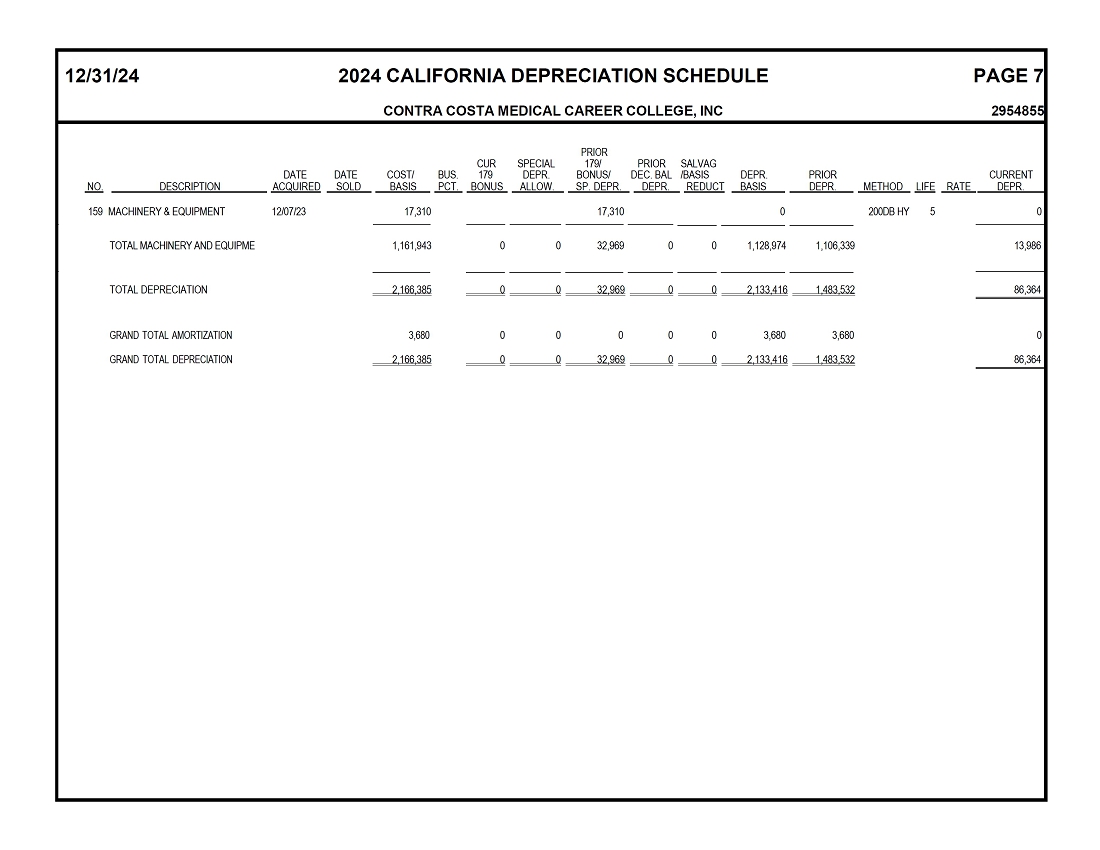

“Purchased Assets” means, other than Excluded Assets, all right, title, and interest in all tangible and intangible assets of Sellers, including, without limitation, Accounts Receivables (except for the Excluded Receivable), security deposits, inventory, supplies (including professional, college, and office supplies, testers, wholesale products, and retail products), equipment, computer equipment, fixed assets, Business Records (except any records included in the Excluded Assets), curricula, work-product, contracts, leases and leasehold improvements, furniture, fixtures, equipment, prepaid expenses, licenses, advertising material, insurance proceeds, permits, signage, software, telephone numbers, website URLs, domain names, goodwill, the use of all names under which Sellers do business other than as included in the Excluded Assets, all Intellectual Property Rights, wherever located and existing as of the Closing and the going concern value associated with them. Exhibit B sets forth equipment, furniture and fixtures of Sellers used in the operation of the College as of December 31, 2023.

“Stock Escrow Agreement” shall have the meaning given in Section 2.3 (d) of this Agreement.

“Student Receivables” means the total of each account receivable for institutional charges by students enrolled, whose accounts are current, including all gap payments, and who are otherwise in good standing at the College as of the close of business on the business day immediately preceding the Closing Date, and for students who have graduated if such account reflects a payment received within ninety (90) days prior to the Closing Date if such a payment is due, all as recorded and reserved in accordance with CCMCC’s historical practices as described in Note 1 of CCMCC’s audited financial statements for the fiscal year ended December 31, 2023.

“Tax Return” means any return, declaration, report, claim for refund, or information return or statement relating to Taxes, including any schedule or attachment, and including any amendment thereof, filed with or submitted to, or required to be filed with or submitted to, any Governmental Authority in connection with the determination, assessment, collection or payment of any Taxes.

“Tax” or “Taxes” means any federal, state, local, or foreign income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental customs, duties, franchise, profits, withholding, social security (or similar), unemployment, disability, real property, personal property, sales, use, capital gain, transfer, registration, transportation, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition to the Tax, whether disputed or not and including any obligations to indemnify or otherwise assume or succeed to the Tax liability of any other Person.

“Title IV Program” means any program of student financial assistance administered pursuant to Chapter 28, Subchapter IV of the HEA, and any amendments or successor statutes to it.

“Unearned Tuition” means tuition and fee charges billed in excess of amounts earned as of a given date and student accounts receivable credit balances. Tuition, lab fees and books are earned straight line over the number of days in each term taking into consideration any externships, less any holidays or other breaks. Course retake and other fees are earned upon billing.

“Working Capital Target” means $0.

| 7 |

ARTICLE II

PURCHASE AND SALE OF ASSETS AND ASSUMPTION OF LIABILITIES.

2.1 Purchase and Sale. Subject to the terms and conditions of this Agreement, at the Closing, Sellers shall sell and deliver to Buyer, and Buyer shall purchase from Sellers, free and clear of all Liens (other than Permitted Liens), the Purchased Assets, in exchange for the Purchase Price. To induce Buyer to enter into the Agreement, at Closing, Sellers shall enter into a Consulting Agreement in the form of Exhibit C hereto and Sellers or its Owners also shall cause the Campus Landlord to enter into the Campus Lease to be negotiated hereafter by Buyer and the Campus Landlord on mutually agreeable terms.

2.2 Liabilities. Except for assumption of the Assumed Liabilities (as defined herein in ARTICLE I), Buyer shall not assume, and shall have no liability for, any Liabilities, obligations or commitments of Sellers or the College of any kind, character or description, whether accrued, absolute, contingent or otherwise, it being understood that Buyer is expressly disclaiming any express or implied assumption of any Liabilities other than the Assumed Liabilities (collectively, the “Excluded Liabilities”), each of which shall be retained and timely discharged by Sellers. Regardless of whether any other Liabilities of Sellers or the College may be disclosed to Buyer or whether Buyer may have actual knowledge of the same, Buyer shall not assume, and Sellers shall pay, perform, and discharge when due and remain exclusively liable for the Excluded Liabilities. For the avoidance of doubt, Excluded Liabilities shall include all Taxes due as a result of the operation of the College prior to the Closing Date or due as a result of the Transaction.

2.3 Purchase Price. As consideration for the sale of the Purchased Assets and the covenants set forth in Section 5.9, Buyer shall pay Sellers the sum of Eight Million Dollars ($8,000,000), subject to the adjustment set forth in Section 2.5 (the “Purchase Price”). The Purchase Price shall be payable as follows:

(a) Six Million Six Hundred Thousand Dollars ($6,600,000), subject to the adjustment set forth in Section 2.5 (the “Cash Purchase Price”), payable in cash by wire transfer or other immediately available funds at the Closing;

(b) Delivery of a promissory note, issued by Buyer and guaranteed by the Buyer Parents, substantially in the form of Exhibit D attached hereto, in the principal amount of Four Hundred Thousand Dollars ($400,000), which shall bear interest at the rate of six percent (6%) per annum and which shall be payable in twelve equal monthly installments of principal and interest, beginning at the one-month anniversary of the Closing Date (the “Promissory Note”), which Promissory Note shall be subject to offsets by Buyer for any Purchase Price Adjustment Payment owed by Sellers, as determined pursuant to Section 2.5, which is not timely paid by Sellers, and also for any indemnification claims made by Buyer pursuant to ARTICLE VII that are not fully resolved prior to the due date of any one or more of the payments due under the Promissory Note.

(c) Delivery by Buyer, for the benefit of Sellers, to CCMCC of the number of shares of common stock in Legacy whose combined value is equivalent to One Million Dollars ($1,000,000) (the “Legacy Shares”), which number of shares shall be based on the value of the Legacy common stock, LGCY, on the New York Stock Exchange, as of the close of business on the business day immediately preceding the Closing Date, and which Legacy Shares Buyer shall cause its Parent-II to issue and convey to it immediately prior to the Closing Date.

| 8 |

(d) All of the Legacy Shares shall be delivered at Closing by Buyer to an escrow agent, jointly selected by the Parties (the “Escrow Agent”), to be held in an account (the “Escrow Account”), together with any earnings and interest thereon, for a period of one year following the Closing (the “Escrow Claim Period”) under the terms of a stock escrow agreement, containing provisions reasonably satisfactory to the Parties and to be entered into at the Closing by the Parties and the Escrow Agent (the “Stock Escrow Agreement”), pursuant to which the Legacy Shares shall be subject to any indemnification claims made by Buyer pursuant to ARTICLE VII that are not fully resolved and satisfied prior to the end of the Escrow Claim Period either by payments made by Sellers or by offsets made by Buyer against any one or more of the payments due under the Promissory Note and with Legacy Shares to be disbursed in accordance with the terms of the Stock Escrow Agreement.

(I) Following the last day of the Escrow Claim Period (the “Expiration Date”), the Legacy Shares shall no longer be subject to any claim that is first made after the Expiration Date, provided, however, with respect to any claims made in accordance with this Agreement on or prior to the Expiration Date (including those that are revised or adjusted in accordance with ARTICLE VII after the Expiration Date) that remain unresolved as of the Expiration Date (“Pending Claims”), all or a portion of the Legacy Shares reasonably necessary to satisfy such Pending Claims (as determined with respect to any indemnification claims based on the amount of the indemnification claim included in the Claim Notice provided by a Buyer Indemnitee under ARTICLE VII, as it may be revised or adjusted in accordance with ARTICLE VII) shall remain in the Escrow Account until such time as such Pending Claim shall have been finally resolved pursuant to the provisions of this Agreement.

(II) After the Expiration Date, Buyer and Sellers shall deliver to the Escrow Agent joint written instructions to disburse to Sellers any Legacy Shares remaining in the Escrow Account that are not subject to (i) Pending Claims or (ii) resolved but unpaid claims in favor of Buyer or other Buyer Indemnitees.

(III) Promptly after the final resolution of all Pending Claims and the payment of all obligations in connection therewith, Buyer and Sellers shall deliver to the Escrow Agent joint written instructions to disburse to Sellers any Legacy Shares remaining in the Escrow Account.

2.4 Acquisition Entirely for Own Account. The Legacy Shares to be delivered to CCMCC hereunder will be acquired for investment for its own account, and not with a view to the resale or distribution of any part thereof, and the Shareholder has no present intention of selling or otherwise distributing the Legacy Shares, except in compliance with applicable securities laws.

2.5 Available Information. CCMCC has such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of receipt of a portion of the Purchase Price hereunder through an investment in Legacy Education Inc., LGCY, and CCMCC acknowledges that an investment in the Legacy Shares involves a high degree of risk, is speculative and there can be no assurance of any return on any such investment.

| 9 |

2.6 Non-Registration. The Shareholder understands that the Legacy Shares have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) and, if issued in accordance with the provisions of this Agreement, will be issued by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of CCMCC’s representations as expressed herein. The non-registration shall have no prejudice with respect to any rights, interests, benefits and entitlements attached to the Legacy Shares in accordance with the charter documents of Legacy Education, Inc. or the laws of its jurisdiction of incorporation.

2.7 Restricted Securities. CCMCC understands that the Legacy Shares may be characterized as “restricted securities” under the Securities Act inasmuch as this Agreement contemplates that, if received by CCMCC pursuant hereto, the Legacy Shares would be acquired in a transaction not involving a public offering. CCMCC further acknowledges that if the Legacy Shares are delivered to it in accordance with the provisions of this Agreement, such shares may not be resold without registration under the Securities Act or the existence of an exemption therefrom.

2.8 Legends. CCMCC understands that the Legacy Shares will bear the following legend or another legend that is similar to the following:

THESE SECURITIES HAVE NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY. THESE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT SECURED BY SUCH SECURITIES.

and any legend required by the “blue sky” laws of any state to the extent such laws are applicable to the securities represented by the certificate so legended.

2.9 Accredited Investor. Except as set forth on the signature page to this Agreement, CCMCC is an “accredited investor” within the meaning of Rule 501 under the Securities Act.

2.10 Post-Closing Student Refunds. To the extent required by Applicable Law, Buyer shall pay student refunds that are Excluded Liabilities under this Agreement, provided, however, that Buyer may seek indemnification for any such payments under Section 7.2.

| 10 |

2.11 Closing Date Purchase Price Adjustment.

(a) At least five (5) business days prior to the Closing Date, Sellers shall provide to Buyer a good faith estimate (the “Estimated Capital Statement”) of Sellers’ Student Receivables, inventory, pre-paid expenses and other current asset accounts, but excluding Excluded Assets and Accounts Receivable other than Student Receivables as set forth above, as of the close of business on the business day immediately preceding the Closing Date (the “Estimated Capital Assets”) and Sellers’ accounts payable, accrued expenses, short-term debt and other current liability accounts that are Assumed Liabilities including, but not limited to, Unearned Tuition as of the close of business on the business day immediately preceding the Closing Date, but not including any Excluded Liabilities and any loan debt initiated by Buyer in connection with its financing, if any, of the Cash Purchase Price (the “Estimated Capital Liabilities”). If the Estimated Capital Assets minus the Estimated Capital Liabilities (the “Estimated Closing Capital”) is less than the Working Capital Target, then the Cash Purchase Price to be paid by Buyer to Sellers at the Closing shall be reduced, on a dollar for dollar basis, by the amount, if any, the Estimated Closing Capital is less than the Working Capital Target, or if the Estimated Closing Capital is greater than the Working Capital Target, then the Cash Purchase Price to be paid by Buyer to Sellers at the Closing shall be increased, on a dollar for dollar basis, by the amount, if any, by which the Estimated Closing Capital is greater than the Working Capital Target.

(b) Within sixty (60) days after the Closing Date, Buyer will present to Sellers a statement (the “Closing Capital Statement”) of Student Receivables, inventory, pre-paid expenses and other current asset accounts, but excluding Excluded Assets and Accounts Receivable other than Student Receivables as set forth above, as of the close of business on the business day immediately preceding the Closing Date (the “Final Capital Assets”) and accounts payable, accrued expenses, short-term debt and other current liability accounts that are Assumed Liabilities including, but not limited to, Unearned Tuition as of the close of business on the business day immediately preceding the Closing Date, but not including any Excluded Liabilities and loan debt initiated by Buyer in connection with its financing, if any, of the Cash Purchase Price (the “Final Capital Liabilities”). For purposes of this calculation, Buyer shall use the accounting methodologies historically used by Sellers, which are described on Schedule 2.5(b), provided, however, such methodology shall be GAAP compliant. If the Final Capital Assets minus the Final Capital Liabilities (the “Final Closing Capital”) exceeds the Estimated Closing Capital, then Buyer shall pay to Sellers, on a dollar for dollar basis, the amount, if any, by which the Final Closing Capital exceeds the Estimated Closing Capital, or if the Estimated Closing Capital exceeds the Final Closing Capital, then Sellers shall pay to Buyer, on a dollar for dollar basis, the amount, if any, by which the Estimated Closing Capital exceeds the Final Closing Capital (each a “Purchase Price Adjustment Payment”).

| 11 |

(c) Sellers shall give written notice to Buyer of any objection to the Closing Capital Statement (the “Objection Notice”) within thirty (30) business days after Sellers’ receipt thereof (the “Review Period”) and all appropriate supporting documentation. The Objection Notice shall specify in reasonable detail the items in the Closing Capital Statement to which Sellers object (the “Objections”) and shall provide a summary of reasons for such Objections. In the event Sellers do not deliver an Objection Notice prior to the expiration of the Review Period, Sellers shall be deemed to have accepted for all purposes of this Agreement Buyer’s Closing Capital Statement. Sellers and Buyer shall use good faith efforts to resolve any Objections. If the parties are unable to resolve any Objections within fifteen (15) business days after receipt by Buyer of the relevant Objection Notice, such dispute shall be referred for decision to the Accounting Firm to decide the dispute within thirty (30) days of such referral. The Accounting Firm shall be instructed to resolve solely the unresolved Objections and such resolution shall be (i) set forth in writing by the Accounting Firm, (ii) delivered to Buyer and Sellers as soon as practicable after the Objections are submitted to the Accounting Firm but no later than thirty (30) days after such submission, (iii) made in accordance with this Agreement, and (iv) final and binding on Sellers and Buyer. Buyer and Sellers shall cooperate fully with the Accounting Firm so as to enable it to make such determination as quickly and as accurately as practicable. Buyer and Sellers shall instruct the Accounting Firm not to assign to any item a value greater than the greatest value for any such item assigned by Buyer, on the one hand, or Sellers, on the other hand, or less than the smallest value for such item assigned by Buyer, on the one hand, or Sellers, on the other hand. The Accounting Firm shall base its decision solely upon the presentations of Buyer and Sellers to the Accounting Firm and upon any materials made available by Buyer and Sellers and not upon independent review. The fees and expenses of the Accounting Firm shall be allocated to be paid by Buyer and/or Sellers based upon the percentage that the portion of the contested amount not awarded to each party bears to the amount actually contested by such party, as determined by the Accounting Firm.

(d) The Purchase Price Adjustment Payment shall be paid by Buyer or Sellers, in accordance with Section 2.5(b) above, (i) within thirty (30) business days of delivery of the Closing Capital Statement, if Sellers do not deliver a timely Objection Notice; (ii) within thirty (30) days of resolution between Buyer and Sellers of all Objections provided in the relevant Objection Notice, if Sellers deliver a timely Objection Notice but the Objections are resolved without any Objections being referred to the Accounting Firm; or (iii) within thirty (30) days of receipt by Buyer and Sellers of the Accounting Firm’s written decision resolving all Objections referred to the Accounting Firm, if Sellers deliver a timely Objection Notice and any Objections are referred to the Accounting Firm for resolution.

2.12 Allocation of Purchase Price. The Parties and their respective Affiliates shall report and file all Tax Returns (including, but not limited to Internal Revenue Service Form 8594) consistent with the allocation set forth on Schedule 2.6 to be completed jointly by the Parties within 90 days after the Closing Date and dated as of such completion date. The Parties agree that this allocation will have been arrived at by arm’s length negotiation between them and that no party will take a position on any income tax return, before any Governmental Authority, that is inconsistent with such allocation without the prior written consent of the other Parties. The Parties further agree that, to the extent required, each of them will properly prepare and timely file Form 8594 in accordance with Schedule 2.6 and Section 1060 of the Code.

ARTICLE III

REPRESENTATIONS OF SELLERS

In order to induce Buyer to enter into this Agreement, each Seller, jointly and severally, represents and warrants as follows:

3.1 Existence and Good Standing of Sellers.

(a) Each of Sellers is a corporation duly formed, validly existing and in good standing under the laws of the State of California and is qualified to conduct business in each jurisdiction where the properties owned, leased or operated, or the business conducted by it require qualification. True, complete and correct copies of the Organizational Documents of Sellers have been provided to Buyer prior to the Effective Date. Sellers do not own or hold the right to acquire any capital stock or other equity or ownership interests of any Person.

| 12 |

(b) Each of Sellers has full organizational power and authority to conduct its business as it is now being conducted, to own or use the properties and assets that it purports to own or use, and to perform all its obligations under the contracts to which it is party.

(c) The Owners are the sole owners of all of the issued and outstanding stock of Sellers and no other Person has any right of any kind to acquire any stock of or other equity interest in such Sellers, including, without limitation, any options, warrants, rights, calls, rights of first refusal, preemptive rights, subscription rights commitments of any type relating to securities, obligations, instruments, equity units or interests of such Sellers.

3.2 Authorization and Binding Obligation. Each Seller and each Owner has all necessary power and authority to execute and deliver this Agreement and to consummate the Transaction. The execution and delivery of this Agreement by Sellers and Owners and the consummation by each of them of the Transaction have been duly authorized by all necessary action on the part of Sellers and Owners. This Agreement has been duly executed and delivered by each Seller and each Owner and, assuming the due authorization, execution and delivery of this Agreement by Buyer, constitutes a valid and binding obligation of Sellers and Owners, enforceable against each of them in accordance with its terms (subject to applicable bankruptcy, insolvency, moratorium, reorganization or similar laws affecting the rights of creditors generally and the availability of equitable remedies).

3.3 No Violations; Required Consents. Except as set forth on Schedule 3.3, the execution and delivery of this Agreement and the consummation of the Transaction and compliance with the provisions of this Agreement will not conflict with, or result in any violation of, or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination or acceleration of any obligation or result in the creation of any Lien upon any of the Purchased Assets under, (a) the Organizational Documents of Sellers, (b) any Material Contract applicable to Sellers, the College or the Purchased Assets included in the Purchased Assets, or (c) any Applicable Law applicable to Sellers, the College or the Purchased Assets. No consent, approval, order or authorization of, or registration or filing with, any Governmental Authority or Educational Agency, is required by or with respect to Sellers in connection with, the execution, delivery or performance of this Agreement by Sellers, except as set forth on Schedule 3.3 (the “Required Consents”).

| 13 |

3.4 Financial Statements; Undisclosed Liabilities. Included as Schedule 3.4 are copies of the financial statements of Sellers (collectively, the “Financial Statements”) consisting of the audited balance sheets of Sellers dated as of December 31, 2022 and 2023, and the related statements of income and statement of cash flows of Sellers for each of the fiscal years then ended (collectively, the “Audited Financial Statements”), and the unaudited balance sheets of Sellers dated as of September 30, 2024 (the “Most Recent Balance Sheet Date”) and the related unaudited statements of income and statements of cash flows of Sellers for the period from January 1, 2024 through the Most Recent Balance Sheet Date (the “Unaudited Financial Statements” and, together with the Audited Financial Statements, the “Financial Statements”). The Financial Statements have been prepared in accordance with GAAP (provided that reconciling journal adjustments have not been made and footnotes have not been provided for the Unaudited Financial Statements) and fairly represent the results of operations and cash flows of Sellers for the periods presented. Schedule 3.4 also includes a complete and accurate list of all Accounts Receivable of Sellers as of the Most Recent Balance Sheet Date, which list sets forth the aging of such Accounts Receivable, all amounts outstanding to Sellers from any current or former students, all scheduled payment dates and all past due amounts, together with Sellers’ bad debt reserve related thereto. Sellers have calculated their bad debt reserves in good faith.

3.5 Title to/Condition of Purchased Assets.

(a) Sellers have good and marketable title to, or a valid leasehold interest in, all of the Purchased Assets. None of the Purchased Assets are subject to any encumbrance, lien, claim, charge, mortgage, pledge or security interest of any kind or nature (collectively, “Liens”), other than the Permitted Liens set forth on Schedule 3.5.

(b) Other than the Excluded Assets, the Purchased Assets constitute all properties and assets necessary to operate the College as currently operated. All items of tangible personal property owned by Sellers and all tangible personal property held by Sellers pursuant to personal property leases or licenses are in reasonably good operating condition, in light of their respective ages, subject to ordinary wear and tear.

3.6 Absence of Certain Changes or Events. Since the Most Recent Balance Sheet Date, there has not been any event, occurrence, circumstance or combination thereof that has had a Material Adverse Effect on Sellers or the College, nor any event, occurrence, circumstance or combination thereof that could reasonably be expected to result in a Material Adverse Effect on Sellers or the College. Since January 1, 2024, except as disclosed on Schedule 3.6, neither Seller has:

(a) been subjected to or permitted a Lien upon or otherwise encumbered any of the Purchased Assets;

(b) sold, transferred, licensed or leased any of its rights, assets or properties with a fair market value in excess of $75,000;

(c) discharged or satisfied any Lien other than a Lien securing any Liability less than $100,000 or paid any Liability in excess of $50,000;

(d) canceled or compromised any indebtedness owed to or by it in excess of $50,000 individually or $75,000 in the aggregate or any claim of or against it in excess of $50,000 individually or $75,000 in the aggregate, or waived or released any right in excess of $50,000 individually or $75,000 in the aggregate;

(e) entered into any transaction or otherwise committed or obligated itself to any capital expenditure in excess of $75,000;

| 14 |

(f) encountered any labor union organizing activity, had any actual or, to the Knowledge of Sellers, threatened employee strikes, work stoppages, slowdowns or lockouts, or had any material adverse change in its relation with its employees, agents, students or suppliers;

(g) made or suffered any change or effect that (individually or in the aggregate) has had, or may reasonably be expected to have, a Material Adverse Effect;

(h) made any change in its accounting policies, except to the extent required by changes in GAAP;

(i) made or suffered any material amendment or termination of any Material Contract other than in accordance with its terms;

(j) paid, or agreed to pay, any increase in compensation payable or to become payable (including any bonus or commission formula) of any kind, other than cost of living increases, to any employee, officer, director or consultant;

(k) changed or suffered any change in any benefit plan or labor agreement affecting any employee of the applicable Seller otherwise than to conform to Applicable Law;

(l) issued any stock or other equity interests of the applicable Seller or options or rights to acquire stock or other similar rights of the applicable Seller, redeemed or repurchased any outstanding stock or other equity interests of the applicable Seller, declared, set aside or paid any dividend or distribution on any stock or other equity interests of the applicable Seller, merged with any other entity or purchased or acquired capital stock or other interest in any other entity, purchased or otherwise acquired capital stock or other interest in any other entity, purchased or otherwise acquired all or substantially all of the business or assets of any other Person, or transferred or sold a substantial portion of its assets to any Person;

(m) entered into any transaction with either or both Owners or any of their Affiliates;

(n) failed to perform any of its material obligations when and to the extent due other than pursuant to a good faith defense or right of setoff;

(o) hired any employees or entered into any employment agreement or other agreement to retain employees or independent contractors with annual compensation in excess of $75,000;

(p) experienced any termination of employment (whether voluntary or involuntary) of (i) any key employee or (ii) any key independent contractor;

(q) failed to renew or obtain an adequate replacement of any insurance policies or experienced any claims in excess of $75,000 under any insurance policies;

(r) taken any action (covertly or overtly) that would be reasonably expected to cause the termination of any Material Contract;

| 15 |

(s) operated other than in the Ordinary Course and in a manner required to support the ongoing operations of Sellers and the College, including with respect to managing working capital, sales and marketing activities, human resources, policies and capital expenditures; or

(t) entered into any agreement, or otherwise obligated itself, to do any of the foregoing.

3.7 Solvency. No insolvency proceedings of any character, including without limitation, bankruptcy, receivership, reorganization, composition, or arrangement with creditors, voluntary or involuntary, affecting Sellers are pending, or to the Knowledge of Sellers, threatened, nor has Sellers made any assignment for the benefit of creditors or taken any action in contemplation thereof.

3.8 Material Contracts. Schedule 3.8 contains a complete and accurate list of all contracts and agreements with annual consideration to or from Sellers in excess of $25,000 or which are otherwise necessary or helpful to the operation of the College as presently conducted, whether written or oral, to which any of Sellers is a party relating to the College or by which any of the Purchased Assets are bound, excepting student contracts, at-will employment agreements and adjunct instructor agreements (collectively, the “Material Contracts”). Sellers have delivered to Buyer a correct and complete copy of each Material Contract. Each Material Contract is in full force and effect. Sellers have performed all material obligations required to be performed by them and they are not in default under or in breach of or in receipt of any written claim of default or breach under any Material Contract. No event or omission has occurred which with the passage of time or the giving of notice or both would result in a default, breach or event of noncompliance by Sellers or, to the Knowledge of Sellers, any other party under any Material Contract. Sellers have not received written or oral notice of the intention of any party to cancel or terminate any Material Contract and to the Knowledge of Sellers, there has not been any breach or anticipated breach by the other parties to any Material Contract. Except as otherwise indicated on Schedule 3.8, each Material Contract included in the Assumed Contracts, to be also included in the Purchased Assets, may be transferred to Buyer pursuant to this Agreement and will continue to be legal, valid, binding, enforceable, and in full force and effect following the consummation of the Transaction. To the Knowledge of Sellers, any Material Contract not included in the Assumed Contracts either can be performed by Sellers or terminated by them without resulting in any Lien upon the Purchased Assets or any other adverse effect upon the Purchased Assets or the College.

3.9 Litigation. Except as disclosed on Schedule 3.9, (a) Since January 1, 2023, there has not been, and there are not currently, any Actions or Proceedings brought by any Governmental Authority, Educational Agency or any other Person, or, to the Knowledge of Sellers, threatened against the College or Sellers; and (b) none of Sellers is subject to any outstanding injunction, judgment, order, writ, decree, ruling or charge. To the Knowledge of Sellers, no event has occurred, and no action has been taken, that is reasonably likely to result in any such Action or Proceeding specified in clause (a) above.

| 16 |

3.10 Taxes. Sellers have filed all Tax Returns relating to its activities required or due to be filed (with regard to applicable extensions) on or prior to the Effective Date. All such Tax Returns are complete and accurate in all material respects. Sellers are not currently the beneficiary of any extension of time within which to file any Tax Return. No material issue relating to Taxes has been raised by a taxing authority during any pending audit or examination, and no material issue relating to Taxes was raised by a taxing authority in any completed audit or examination, that reasonably can be expected to recur in a later taxable period. All Taxes due and owing by Sellers relating to the College have been paid (whether or not shown on any Tax Return and whether or not any Tax Return was required). Other than Permitted Liens, there are no existing Liens for Taxes on any of the Purchased Assets and, to the Knowledge of Sellers, there are no Tax obligations of Sellers which could result in the assertion of Liens against the Purchased Assets.

3.11 Undisclosed Liabilities. Sellers do not have any Liability, except for Liabilities set forth on the Financial Statements or those incurred in the Ordinary Course of Business since the Most Recent Balance Sheet Date.

3.12 Compliance with Laws; Permits. Except with respect to Educational Approvals (which are the subject of Section 3.14), (a) Schedule 3.12 includes a correct and complete list of all Licenses held by Sellers with respect to the operation of the College, (b) Sellers have delivered to Buyer correct and complete copies of each such License, including any amendments and other modifications to each such License, and (c) each such License has been validly issued, and Sellers are the authorized legal holder thereof. The Licenses listed on Schedule 3.12 comprise all of the licenses, permits, and other authorizations required from any Governmental Authority for the lawful conduct of the College (other than Educational Approvals listed on Schedule 3.14(c)) and none of the Licenses is subject to any unusual or special restriction or condition that could reasonably be expected to limit the full operation of the College. Each License is in full force and effect, and the operation of the College is in material accordance with the Licenses. Sellers are now and have during the past three (3) years been in compliance, in all material respects, with all Applicable Laws. None of Sellers has received written notice of any violation by Sellers of Applicable Law. Nothing in this Section 3.12 shall be deemed to apply to compliance with Applicable Laws related to Educational Agencies, which matters are addressed in Section 3.14.

3.13 Environmental Matters. To the Knowledge of Sellers, Sellers have complied in all material respects with and are currently in compliance in all material respects with all Environmental and Safety Requirements with respect to the College, and Sellers has not received any written notice, report, or information regarding any liabilities (whether accrued, absolute, contingent, unliquidated, or otherwise) or any corrective, investigatory, or remedial obligations arising under Environmental and Safety Requirements which relate to the College or real property owned, leased or used by the College.

3.14 Educational Approvals.

(a) Except as set forth on Schedule 3.14(a), Sellers and the College are currently, and since January 1, 2022 (the “Compliance Date”), have been, in compliance, in all material respects, with all applicable Federal, state and local laws and regulations and with all applicable ACCET standards, policies and procedures.

(b) Schedule 3.14(b) includes a correct and complete list of every program the College has provided or is providing or administering, since the Compliance Date, any form of student financial assistance, grants, or loans including Title IV Program funding (“Financial Assistance”) to any students enrolled in the College and the dates during which such Financial Assistance is or was provided by the College.

| 17 |

(c) Schedule 3.14(c) includes a correct and complete list of Educational Approval issued to the Sellers and currently in effect for the College, with respect to the educational programs offered by the College. No application made by Sellers or the College for an Educational Approval since the Compliance Date, has been denied, regardless of whether the Educational Agency appears on Schedule 3.14(c).

(d) Sellers have all Educational Approvals necessary to operate the College in the manner operated on the Effective Date. Each such Educational Approval is in full force and effect, is a valid, binding, and enforceable obligation by or against Sellers and the College, and no event has occurred that constitutes or, with the giving of notice or the passage of time, or both, would constitute, a default or breach thereunder. No proceeding for a disallowance or fine or for the limitation, suspension or cancellation of any Educational Approval issued to Sellers or the College is pending or, to the Knowledge of Sellers, threatened. Sellers have not received notice that any Educational Approval will not be renewed and, to the Knowledge of Sellers, there is no basis for non-renewal. Since the Compliance Date, there has not been any investigation, audit, or review, with the exception of routine financial and compliance audits and scheduled accreditation or regulator visits, of the programs of Financial Assistance in which Sellers or the College is participating or has participated or of the Educational Approvals issued to Sellers or the College by any Educational Agency (“Compliance Reviews”). In addition, to the Knowledge of Sellers, no fact or circumstance exists that would, or would reasonably be likely to (A) result in the termination, revocation, suspension, restriction or failure to obtain renewal of any Educational Approval or the imposition of any fine, penalty or other sanction for violation of any legal or regulatory requirements related to any Educational Approval or (B) cause any Educational Agency to refuse to deliver any post-Closing Educational Consent. Schedule 3.14(d) provides a complete and correct list of all Compliance Reviews that have been conducted at the College since the Compliance Date.

(e) Schedule 3.14(e) includes a correct and complete list of the full address of the main campus of the College and any other campus at which the College now offers, or since the Compliance Date has offered, any portion of an educational program. The College does not offer any educational instruction at any site, building, or facility other than (i) the addresses set forth on Schedule 3.14(e), or (ii) at any business location at which students of the College perform externships.

(f) Since the Compliance Date, Sellers and the College have timely reported: (i) the addition of any new educational programs or locations; and (ii) any shifts in ownership or control, including any changes in reported ownership levels or percentages. With respect to any location or facility that has closed or at which the College ceased operating educational programs, Sellers and the College have complied with all Applicable Laws related to the closure or cessation of instruction at that location or facility, including requirements for teaching out students from that location or facility.

| 18 |

(g) To the Knowledge of Sellers, since the Compliance Date, neither Sellers nor the College have received any written notice of any investigation by any Governmental Entity or Educational Agency regarding Seller’s student lending practices.

(h) Since the Compliance Date, no entity or organization that has a student lending relationship with Sellers and which provides or originates private educational loans has provided formal written notice to Sellers or the College terminating or otherwise significantly modifying or reducing the availability of such loans to students enrolled in the College.

(i) Since the Compliance Date, neither Sellers nor the College has provided any educational instruction on behalf of any other institution or organization and, other than externships, no other institution or organization has provided any educational instruction on behalf of the College.

(j) Sellers and the College are in material compliance with all Educational Agency requirements and regulations, relating to (i) fair and equitable refunds policy and (ii) the calculation and timely repayment of federal and nonfederal funds, and any and all refunds required thereunder as of the Effective Date have been timely paid by Sellers and the College.

(k) Since the Compliance Date, Sellers and the College have complied, in all material respects, with all Educational Agency requirements concerning student outcomes, including retention, completion and placement rates and the proper methodology for calculating and timely reporting such rates.

(l) Neither Sellers nor any Person that exercises Substantial Control over Sellers or the College, or any member of such Person’s family (as the term “family” is defined in 34 C.F.R. § 600.21(f)), alone or together, (i) exercises or exercised Substantial Control over another institution or third-party servicer (as that term is defined in 34 C.F.R. § 668.2) that owes a Liability for a violation of a Title IV Program requirement or (ii) owes a Liability for a Title IV Program violation.

(m) Neither Sellers nor the College has employed any individual who has been convicted of, or has pled nolo contendere or guilty to, a crime involving the acquisition, use or expenditure of funds of a Governmental Entity or Educational Agency, or has been administratively or judicially determined to have committed fraud or any other violation of Applicable Law involving funds of any Governmental Entity or Educational Agency, since the Compliance Date.

(n) Neither Sellers, the College, the Owners, nor any Affiliate that has the power, by contract or ownership interest, to direct or cause the direction of the management or policies of Sellers or the College has filed for relief in bankruptcy or had entered against it an order for relief in bankruptcy, since the Compliance Date.

(o) Neither the Owners, nor any executive or financial aid officer of Sellers, has pled guilty to, pled nolo contendere to, or been found guilty of, a crime involving acquisition, use or expenditure of funds under the Title IV Programs or been judicially determined to have committed fraud involving funds under the Title IV Programs.

| 19 |

(p) Neither Sellers nor the College have, since the Compliance Date, contracted with or employed any Person that has been, or whose officers or employees have been, convicted of, or pled nolo contendere or guilty to, a crime involving the acquisition, use or expenditure of federal, state or local government funds, or administratively or judicially determined to have committed fraud or any other material violation of Applicable Law involving federal, state or local government funds.

(q) Since the Compliance Date, neither Sellers nor the College have contracted with an institution or third-party servicer that (i) has been terminated under Section 432 of the HEA for a reason involving the acquisition, use or expenditure of funds of a Governmental Entity or Educational Agency or (ii) has been administratively or judicially determined to have committed fraud or any other violation of Applicable Law involving funds of any Governmental Entity or Educational Agency.

(r) As of the Effective Date and the Closing Date, Sellers and the College are in material compliance with Applicable Law regarding institutional loans and private educational loans, including applicable provisions of the Higher Education Opportunity Act of 2008 (Public Law 110-315).

(s) Sellers have made available to Buyer true and complete copies of, all material correspondence and documents received from, or sent by or on behalf of the College to any Educational Agency that were: (i) sent or received since the Compliance Date or relate to any issue which remains pending as of the Effective Date hereof, and (ii) relate to (1) any notice that any Educational Approval is not in full force and effect or that an event has occurred which constitutes or, with the giving of notice or the passage of time or both, would be expected to result in the revocation of such Educational Approval; (2) any written notice that the College has violated or is violating any legal requirement, regulation, or rule related to any applicable Educational Agency, or any legal requirement, regulation, or rule related to maintaining and retaining in full force and effect any Educational Approval; (3) any audits, program reviews, investigations or site visits conducted by any Educational Agency, any Governmental Entity or any independent auditor concerning compliance with the statutes, regulations or other requirements of such Educational Agency, Governmental Entity, or independent auditor; (4) any notice of an intent to limit, defer, show cause, suspend, terminate, revoke, cancel, not renew or condition (including any action placing the College or location thereof on probation) the accreditation of the College; or (5) any notice requiring the posting of a letter of credit or other surety in favor of any Educational Agency.

(t) Sellers have provided to Buyer any information obtained or created by Sellers or the College since the Compliance Date regarding (1) all formal material written complaints about the College, including complaints from students, employees, and employers of graduates of the College, (2) all reports submitted to any Educational Agency regarding completion and placement rates, as well as copies of all internal reports regarding completion and placement that have been prepared by Sellers or College, and (3) all enrollment data, including population and lists of student starts and completions.

(u) Schedule 3.14(u) sets forth a list of all locations at which any students of the College receive clinical training as of the Effective Date, which shall include the name of the provider, a designated contact person if applicable, address, telephone number and email address. The business records of the College with respect to locations and providers of clinical training to students of the College since the Compliance Date are materially correct.

| 20 |

(v) Except as listed on Schedule 3.14(v), since the Compliance Date, Sellers have not received any notice with respect to any alleged material violation of any legal requirement with respect to the College, including with respect to recruitment, sales and marketing activities, or the terms of any program participation agreement to which Sellers or the College is or was a party.

(w) Except as listed on Schedule 3.14(w), since the Compliance Date, the College has been “financially responsible” as that term is used in 34 C.F.R. Subpart L, including meeting or exceeding any financial ratios, “composite score” and financial performance requirements of DOE and/or ACCET, and the College has not been required to post a letter of credit in favor of the DOE to establish its financial responsibility based on its “composite score” or due to any mandatory or discretionary “trigger” conditions or events as described in 34 C.F.R. § 668.171 or to satisfy the requirements of 34 C.F.R. § 668.173 regarding late returns of Title IV Program funds, nor has the College been placed on heightened cash monitoring Title IV Program funding or suffered any other sanction by the DOE.

(x) The official cohort default rates for the College, calculated in the manner prescribed by DOE, for federal fiscal years FY 2017, 2018, 2019 and 2020 for the College are set forth on Schedule 3.14(x).

(y) Except as disclosed on Schedule 3.14 (y), neither Sellers, nor the College, currently contract with a third-party servicer (as that term is defined in 34 C.F.R. § 668.2) to provide any services in connection with the processing or administration of the College’s Financial Assistance.

(z) The College is preparing to timely report, and will be in a position to timely report, to the DOE, on or before January 15, 2025 all data required under the new Gainful Employment Reporting Requirements established in 34 C.F.R. § 668.408 (2024)(“Gainful Employment Data”). Sellers have provided to Buyer or will timely provide to Buyer, as the information becomes available, true and complete copies of all Gainful Employment Data filed by the College with the DOE on or prior to October 1, 2024.

(aa) Since the Compliance Date, the College has not received greater than ninety percent (90%) of its revenues from Title IV Program funds for any fiscal year, as such percentage is required to be calculated by 34 C.F.R. § 668.28.

(bb) Since the Compliance Date, the College has been in compliance with 34 C.F.R. § 668.14(b)(22), and applicable sub regulatory guidance, prohibiting the payment of any commission, bonus, or other incentive payment based directly or indirectly on success in securing enrollments or Title IV Program funding to any admissions representative, agent, or any other Person engaged in any student recruiting or admission activities or in making decisions regarding the awarding of Title IV Program funds for or on behalf of the College.

| 21 |

3.15 Employees and Benefits.

(a) Schedule 3.15(a) contains a complete and accurate list as of the date of this Agreement of (i) the names of each employee employed by Sellers and each such employee’s title and date of hire, (ii) the rate of all compensation paid by Sellers to each such employee in calendar year 2023, plus any bonus, contingent or deferred compensation related to calendar year 2023, and (iii) Sellers’ accrued vacation liabilities (including sick days and floating holidays). To the Knowledge of Sellers, no employee of Sellers, nor any consultant or independent contractor with whom Sellers has contracted for services to the College, is in violation of any term of any employment contract, proprietary information agreement or any other agreement relating to the right of any such individual to be employed by, or to contract with, Sellers. With respect to the College, there is no employment-related charge, complaint, grievance, investigation, inquiry, or obligation of any kind, pending or, to the Knowledge of Sellers, threatened in any forum, relating to an alleged violation or breach by Sellers (or its officers or managers) of any Applicable Law, or contract, nor is there any reasonable basis therefor. To the Knowledge of Sellers, other than the Owners, no officer, key employee or group of employees of Sellers intends to terminate his, her or their employment or engagement with Sellers, other than in accordance with Section 5.11 hereof, nor do Sellers have a present intention to terminate the employment of any of their officers, key employees or group of employees.

(b) Except as set forth on Schedule 3.15(b), Sellers do not have and do not currently maintain or contribute to (i) any incentive, bonus, commission, deferred compensation, severance or termination pay plan, agreement or arrangement, whether formal or informal and whether legally binding or not; (ii) any pension, profit-sharing, equity purchase, equity option, group life insurance, hospitalization insurance, disability, retirement or any other employee benefit plan, agreement or arrangement, whether formal or informal and whether legally binding or not; (iii) any fringe benefit plan, agreement or arrangement, whether formal or informal and whether legally binding or not; or (iv) any other “employee benefit plan” as such term is defined in Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). Any and all employee benefit plans currently maintained by Sellers are in compliance in all material respects with the requirements prescribed by any and all Applicable Law, including ERISA and the Internal Revenue Code, that are applicable to such plan.

(c) Sellers have not engaged in a transaction in connection with which it is subject either to a civil penalty assessed pursuant to Section 502(i) of ERISA or a tax imposed by Section 4975 of the Code.

(d) Sellers have not had, and do not currently have or maintain any “qualified plan” that meets, purports to meet, or is intended to meet the requirements of Section 401(a) of the Code.

(e) Sellers have not and do not currently maintain or contribute or been required to contribute to a “multiemployer plan,” as such term is defined in Section 3(37) of ERISA.

(f) There are no liabilities existing under any Seller employee benefit plan that have resulted, or could result, in the imposition of a Lien upon the Purchased Assets.

| 22 |

3.16 Intellectual Property.

(a) Schedule 3.16 contains a true, correct and complete list of all Intellectual Property Rights of Sellers relating to the College and its respective operations. Schedule 3.16 also contains a complete and accurate list of all material licenses granted by Sellers to any third party and all material licenses granted by any third party to Sellers relating to the College, in each case identifying the subject Intellectual Property Rights, excluding off-the-shelf “shrink wrap” license agreements used by the College. Sellers have provided to Buyer correct and complete copies of all documents embodying such licenses.

(b) Sellers owns and possesses, free and clear of all Liens (other than the Permitted Liens set forth on Schedule 3.5), all right, title and interest in and to, or has the right to use pursuant to a valid and enforceable written license, all Intellectual Property Rights necessary for or used in the operation of the College as conducted as of the Closing Date. Sellers have not received any written notice of invalidity, infringement, or misappropriation from any third party with respect to any Intellectual Property Rights required to be listed on Schedule 3.16, and, to the Knowledge of Sellers, there is no reasonable basis for any such claim. To the Knowledge of Sellers, they and the College have not interfered with, infringed upon or misappropriated any Intellectual Property Rights of any third parties. To the Knowledge of Sellers, no third party has interfered with, infringed upon or misappropriated any Intellectual Property Rights of Sellers.

3.17 Students. Schedule 3.17 sets forth, as of September 30, 2024, a true, correct and complete list of (a) all students enrolled, (b) tuition amounts for the current period enrolled, (c) total tuition payments charged to such student, and (d) total tuition payments received to date from such student. Sellers agree that Schedule 3.17 shall be updated, no later than ten (10) business days prior to the Closing, to reflect all students enrolled as of the most recent month ending prior thereto.

3.18 Affiliate Transactions. Except as set forth on Schedule 3.18, no officer, director, member, equity holder or Affiliate of Sellers, or any individual related by blood, marriage or adoption to any such Person or any entity in which any such Person owns any beneficial interest, is a party to any contract or transaction with Sellers or has any material interest in any of the Purchased Assets.

3.19 Broker’s or Finder’s Fees. Except as disclosed on Schedule 3.19, no Person retained by Sellers or Owners is or will be entitled to any broker’s or finder’s fee or any similar commission or fee in connection with the Transaction contemplated by this Agreement.

3.20 Insurance. Sellers maintain the insurance policies set forth on Schedule 3.20. To the Knowledge of Sellers, such insurance policies are sufficient for compliance with all Applicable Laws and Material Contracts. All due premiums have been paid and coverages under those insurance policies are in full force and effect. There are no claims related to the College, the Purchased Assets or the Assumed Liabilities pending, and to the Knowledge of Sellers, no circumstances exist or events have occurred that are reasonably likely to give rise to claims, under any such insurance policies.

| 23 |

3.21 Real Properties.

(a) Sellers do not own, nor have they owned during the past three (3) years, any real property; provided, however, that the real property where the College Campus is located is owned by Campus Landlord, an Affiliate of Owners.

(b) Schedule 3.21(b)(i) contains a true and complete list of all real property leased, subleased, licensed or otherwise occupied by Sellers as tenant, subtenant or pursuant to other occupancy arrangements (together with all fixtures and improvements thereon, the “Leased Real Property”), and for each Leased Real Property, identifies the common street address of such Leased Real Property and the lease, contract, agreement or other arrangement pursuant to which the applicable Seller occupies such Leased Real Property, including all amendments, supplements or other modifications thereto (each, a “Lease”). A true and complete copy of each Lease has been made available to Buyer. With respect to each Lease, except as set forth on Schedule 3.21(b)(ii): (i) the applicable Seller has a good, valid and assignable interest or estate in such Lease, free and clear of all Liens (other than Permitted Liens); and (ii) such Lease is in full force and effect, valid and enforceable against the applicable Seller and, to the Knowledge of Sellers, any other party thereto in accordance with its terms without any material default or waiver thereunder by the applicable Seller or, to the Knowledge of Sellers, by any other party thereto.

3.22 Business Records. Except as set forth on Schedule 3.22, the Business Records are correct and complete in all material respects.

3.23 Representations and Warranties. Except for the representations and warranties contained in this ARTICLE III (including the related portions of the Schedules), neither of Sellers nor any other Person has made or makes any other express or implied representation or warranty, either written or oral, on behalf of Sellers or Owners, including any representation or warranty as to the accuracy or completeness of any information regarding the College and the Purchased Assets furnished or made available to Buyer and its representatives or as to the future revenue, profitability or success of the College, or any representation or warranty arising from statute or otherwise in law, provided that, for avoidance of doubt, the provisions of this Section 3.23 shall not be deemed to modify in any way the definition of Material Adverse Effect in Article I nor to authorize or immunize from liability any claim for Fraud relating to any representations or warranties set forth in this Article III or in the Disclosure Schedules that otherwise would be actionable under Applicable Law as recognized in Section 7.2 (a) & (c).

ARTICLE IV

REPRESENTATIONS OF BUYER

Buyer represents and warrants to Sellers and Owners as follows:

4.1 Existence and Good Standing of Buyer. Buyer is a limited liability company duly organized, validly existing and in good standing under the laws of the State of California. Buyer has all requisite corporate power and authority to own, lease and operate its properties and to carry on its business as now being conducted. Buyer is a wholly owned subsidiary of Buyer Parent-1, Legacy Education, LLC, a limited liability company duly organized, validly existing and in good standing under the laws of the State of California, which, in turn, is a wholly owned subsidiary of Buyer Parent-2, Legacy Education, Inc., a corporation duly organized, validly existing and in good standing under the laws of the State of Nevada.

| 24 |